Who doesn’t like a fresh start? We all like a clean slate and a chance to begin again and just go forward. That’s what these free printable monthly and yearly finance goal sheets aim to do. You can’t go back in time and make different financial decisions, but you can do it from now on.

This finance goals printables set is broken up into monthly and yearly goals which is part of a larger essential finance set called the mini budget binder. I’ll provide the links to that below. Grab and print them for your binder. It makes a huge difference!

📎 Setting Goals

This is a big question. You’ll need to start small, get a handle on your expenses and income first, and then use these printables to set goals. So let’s get started!

To get a full understanding of your current financial health, work on all of the sheets in the binder. They all tie together. You can’t say “I”m going to set a goal of saving $200 a month” if you literally don’t have $200 a month extra to save. This is not a super quick process. It will take time and I will almost guarantee you that you will have to update these sheets several times over the next few months.

Now that you have tracked all of your finances, look over where you stand and NOW we can make those monthly and yearly goals. Think about what is important to you and start there.

💲 Set SMART Goals

Let’s start out by using SMART Goals. Too many times we set these crazy high expectations like “I’m going to lose 20 pounds by summer” and then we don’t. Then we blame goal setting and not really look at WHY we didn’t achieve our goals.

What are SMART GOALS? It is an acronym meaning:

- Specific

- Measurable

- Attainable

- Relevant

- Timely

Examples for these are:

📌Specific – I will stop drinking coffee at the coffee house on my way to work.

📌Measurable – I can see that I no longer have that $4.00 cost on my Daily Spend Log.

📌Attainable – Start small. What can you reasonably accomplish this week? Maybe it is to skip the restaurant on Friday and eat a frugal meal at home? Maybe it is to bring a cup of coffee from home instead of buying one.

📌Relevant – If I stop at a coffee shop everyday on my way to work, that is costing me $4.00 per day. At the end of a five day workweek, that is a $20.00 impact. It is highly relevant to your goal.

📌Timely – It can happen right now. I don’t have to rely on anyone else to make it happen besides myself. So the timeliness is all dependent on doing it myself.

📋 Monthly Finance Goals

Think about what you want to accomplish THIS MONTH. Write them down and put this on the refrigerator so you can see it EVERYDAY! Don’t hide it and think “oh I’ll remember it.” Nope, it doesn’t work like that. Think about all the work you have done in the Daily Spending Log or the Debt Payoff.

- Do you want to stop drinking take out coffees?

- Maybe you want to cut back on cable TV?

- Do you want to cut back on entertainment costs and start finding frugal things to do?

All of these thoughts are going to go onto your Monthly Goals sheet as ACTIONABLE STEPS towards meeting your goals. Go back to the SMART GOALS above. Think about it through that lens.

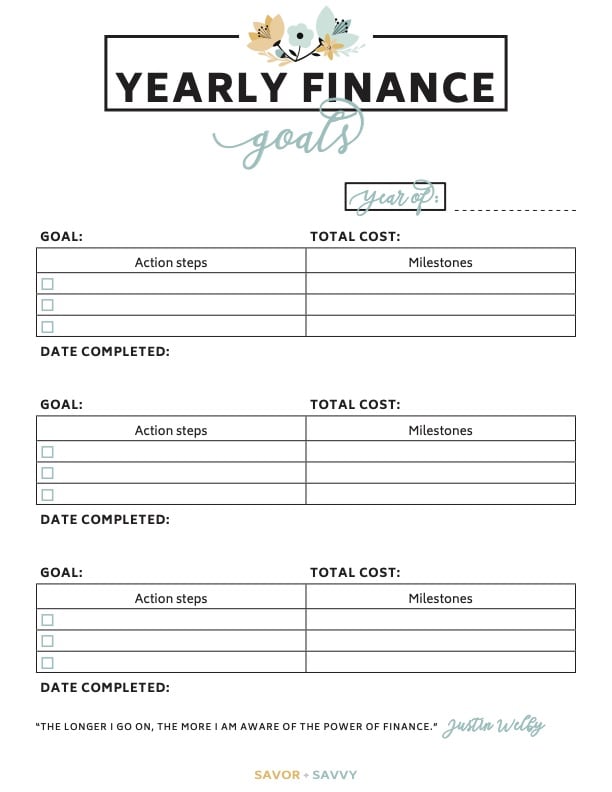

📒 Yearly Finance Goals

Once you have the Monthly Goals down, you can do the same steps to building out your Yearly Goals knowing you have 12 months to work towards the goal rather than just 30 days.

💻 Grab It Now

✅I’ll deliver these goal sheets to your email inbox as soon as you enter your info below. They match all the other financial binder printables are designed to help you take control of the year and your finances!

✅Open the PDF using any PDF reader app (my go-to is the free Adobe Reader). Go to File->Print and simply hit the Print button if you’re using regular U.S. Letter paper.

✅You can change the type of paper used (such as A4, A5,…etc.) or adjust the Scale setting if you have to.

Enjoy!

💵 Other Free Finance Printables

👉Printable Monthly Bill Worksheet – Start here. List ALL of your current bills and start tracking them. This sheet helps you pay each one and not miss a payment. We’ve all done it by accident – I get it – but this little tool helps you minimize those silly mistakes.

👉Budget Planner – This helps you record your household income and subtract the items from the bill worksheet above to figure out your financial standing. As your income or expenses change, you should update the sheet.

👉Printable Debt Payoff – Next up is look at your debt. It won’t be fun, I am sure. But, you need to start tracking it and the speed in which you pay it off. Again, you can’t save that $200 mentioned above if you have a load of credit card debt that you can’t eliminate. Write it down and you stand a much better chance to make a difference.

👉Printable Daily Spending Log – This one is probably the least favorite among readers, but it is one of the most crucial. It is the little spends you do each and every day that add up to the big cost at the end of the month. Track the coffees, muffins, drive thru visits and office donations. They all add up and you will quickly realize where you need to cut. It doesn’t take long, I promise.

👉Printable Expense Worksheet- Another one that you need to print off and start working on! This one is quick to point out where your expenses are going that you might be missing otherwise! Don’t think you know where everything goes-this one shows you! Important tool for your budgeting!

👉$1000 Emergency Fund Savings Challenge-this is so much fun if you are a challenge freak like I am! I love to watch the money grow and as it gets to be a larger sum, it gives me more incentive to find ways to cut back. The first few dollars are hard but then the brain kicks in and has fun with this one!

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

Leave a Reply