This Emergency Fund Tracker Printable will challenge you to set up an $1000 emergency stash so you are ready for those 911 days.

Creating an Emergency Fund or a dedicated savings account set up to cover unexpected expenses will reduce stress and anxiety when emergencies arise.

Too many of us just aren’t prepared for an unexpected bill, job loss or means to cut down debt.

Bankrate estimates that 28% of Americans have no emergency fund at all. CNBC says that a $1000 Emergency would set most Americans into Debt. New York Times says that even in strong economies, most families don’t have enough emergency savings.

Our goal is to help you be prepared for the unexpected, so you don’t end up as one of those statistics.

💰Why This Works

Actionable Steps to Take | Creating this emergency fund chart is much easier to do if you are given the tools on HOW to do it and HOW to find the money to add to it. We give you 20 different ways to take action on your money right now to help start filling in money on your own tracker.

Reasonable | This printable savings chart is reasonable and reachable for most of us. You may not use all 20 ways to find money in your house, but you can use a lot of them. Most people are not honestly doing all of these things to scale back the spending and find the extra pennies here and there that will add up.

Realistic | All of the items that you are going to be doing to get to your goal can be crossed off or colored in as you progress.

💰Why You Need Emergency Funds

What do you do when an unexpected event happens in your life and you have to outlay money? You know the ones:

- Large medical bill

- New set of tires

- Oven broke (which happened to us last week)

- Leak underneath the sink

When living paycheck to paycheck (which 54% of Americans do) having a stash of money set aside for these unforeseen events is crucial.

❓ How Much Is Needed to Create the Dave Ramsey Emergency Fund?

Although there are many experts that suggest having 3-6 months salary saved, Dave Ramsey suggests starting out with $1000. In this case, you are looking to cover the most common unexpected expenses.

Just starting out, shoot for the $1000 as this chart focuses on with each block being divided up into $10 increments.

🏦 Examples to Use

- New refrigerator

- Replacement of hot water heater

- Car repairs

- Job reduction or loss

- Unexpected medical or dental treatment

💵 Find Money to Build Up Your Fund

When it’s time to save money, it’s also time to become creative to meet the fund challenge. For this one, I broke up the goals into small, manageable $10 increments. It is done that way to be easy and obtainable for most of us.

If you think “wait, that is still too far off!!” It’s ok, let me help with a few creative ideas. Since we know money is not going to fall from the sky, you will have to give it a little bit of work.

1. 🪙 Penny Challenge

You have to start somewhere so the Penny Challenge is great for beginners and those that really are down and out financially. Scraping by the little pennies all add up and you will build up a fun in a little over a year just by saving PENNIES.

2. 💳 52 Week Savings Challenge

We are passionate about this one as it was a personal kick starter for us when we changed the way we spent money. We loved seeing how fast we were able to gather some funds and made us step back and evaluate our day to day spending.

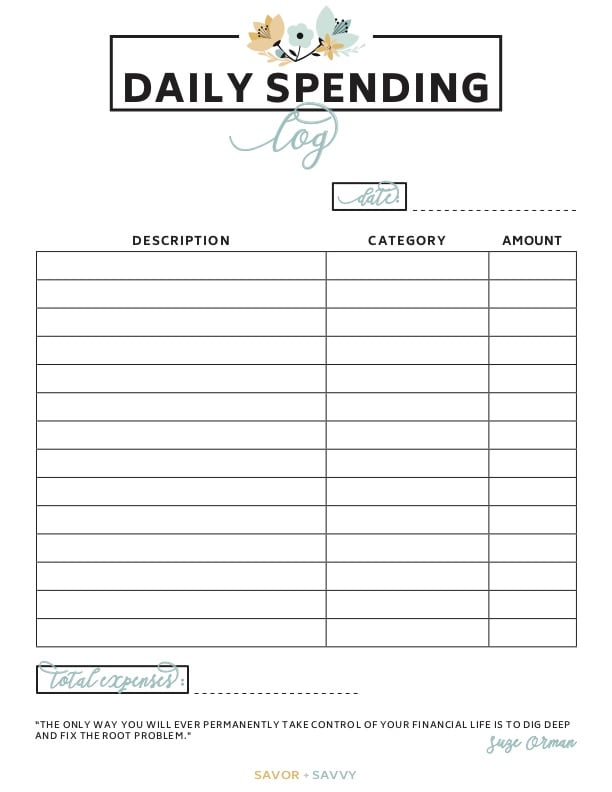

3. 💰 Daily Spending Printable

Use the Daily Spending Printable and see where your money is going on a DAILY basis. A lot of us think we have no money until we realize we are spending $6 for take-out coffee and $10 for take-out lunch. Remember, you “weren’t spending anything.”

The $1000 Savings Challenge Printable is also a great way to minimize unnecessary gathering at the grocery store. Were you spending money on magazines that you looked at for just a few minutes before throwing them away?

Take the time to write down all of your spendings to see where you can find opportunities. You might be able to change morning coffees and fund your account on just that one change in your life!

4. 🏦 Expense Printable

Use the Expense Printable to keep track of all of your expenses in your house. You are looking for each and everything that you spend money on. This differs from the Daily Spending Log.

The Daily Spending logs what comes out of your Debit card or what you are spending from your cash or checkbook. The Expense Tracker will catch your cell phone bill, Netflix…this is the perfect time to catch if you are being charged for three different streaming accounts (urgh! Hulu, Netflix and Amazon!). Let’s not go into details on how that happened to me! 💸💸💸 Maybe freeing up one of those will help you meet your goals.

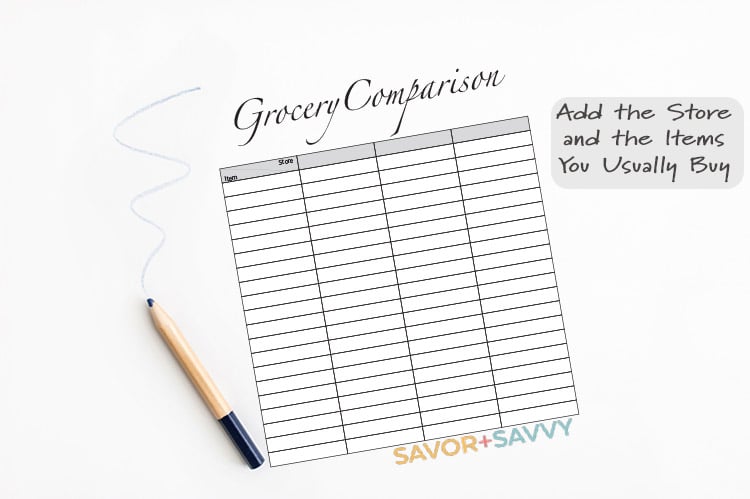

5. 🛍️ Grocery Comparison Printable

Use the Grocery Comparison Printable to see where you could start saving money on your groceries. This nifty tool takes a little bit of energy to set up, but it resulted in significant savings EACH WEEK for me.

Saving money takes effort, I’m not going to lie to you here. This is one piece of the puzzle that can save you so much money. Yes, you are going to compare prices from two or three of your local grocery stores with the common items that you buy.

But, you’ll quickly find areas to make smart grocery shopping decisions and start saving. This will take you about 2-3 hours of work including travel time but will add money to your checking account each and every week.

6. 🔌 Tips to Save Money on Electric and Water Bill

Ask your utility company if they have ideas on how to reduce your Electric and Water Bill. Many of them will come out and audit your house. This will generally take 2-3 months to feel the difference in your bill.

7. 📎 Money Envelope Templates

The Money Envelope Template is the game changer! This takes budgeting to a whole new level. Separate your weekly money into different envelopes and only spend what is in that envelope for that purpose.

It requires discipline, but leftover money can be used for your savings It’s funny, but seeing the cash in an envelope changes the way you think about spending it.

8. 📒 Track Your Monthly Bills

Use the Monthly Bill Worksheet to track your bills so you don’t end up paying late fees because you accidentally missed a bill. That is just throwing money away! If you check off every time you pay your cable bill (if you are on auto-pay – bless you!!) then you know you’ve paid it and you don’t have to fear those pesky late fees…each one can be $10-35 EACH! Um, no way!

9. 📋 Save Money with Meal Planners

Plan out your weekly meals using a Meal Planner! How many times do we randomly go to the store and pick up stuff for dinner or hit the drive-thru because we didn’t take a few minutes to plan? We’ve all done it, but it’s time to change. Using a Meal Planner helps you take 15 minutes to look at your personal calendar and match it to the days/meals. That’s it! Go to the store and plan the week. Eliminate those random stops that cost you more money because you got too busy to cook one night.

The more we go to the store, the more we spend. We have several versions you can choose from. We are that passionate about it! Another, another, another, and I have even used a generic monthly calendar to make one before. They all work, just find one that works for you! Bonus one here!

10. 🥣 Cook Frugal Meals

Since you are meal planning, make sure to toss in some economical meals as well. Just cooking a couple of these a week will allow you to help fund that Emergency Account quickly. Check out 100 Frugal Dinner Ideas, 19 Black Bean Dinners, and 10 Weeks of Frugal Weekly Meal Plans! Given all of these recipe ideas, you can come up with more than a handful of ideas to shave a few bucks a week off of your grocery bill.

11. 💕 Frugal Date Night Ideas

Re-evaluate how you do date nights! We used to think that going to expensive dinners or events is what made a perfect date night. Then we realized that the memories and photos tend to be from when we went on bike rides, camping or hiking. Throw that extra dough into your Emergency Fund instead!

12. 💸 Creative Ways to Save Money at Home

Check out 50+ Grocery Items to DIY Instead of Buy as another option to find some cash. You can do these right now to help you start saving that Emergency Fund.

13. 💲 Use Old Fashioned Skills

7 Old Fashioned Frugal Skills might be the one that works well for you. Looking back through the decades, these are tried and true ways to save big bucks if you are willing to put in a little bit of work. Remember, nothing comes for free!

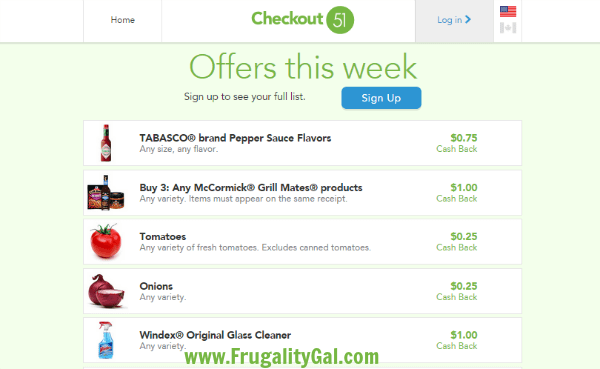

14. 📱 Use Checkout 51 to Save More Money on Groceries

If you haven’t grabbed the app, Checkout 51, now is the time! How to Save Money Using Checkout 51 is a little bit of a goldmine! You simply check on your app what is on sale that you normally purchase, make the purchase and scan your receipt! It is that easy!

15. 💵 Making Frugal Choices By Swapping Items

Learn how to make a few of your own things instead of buying them like paper towels and facial wash! 5 Money-Saving Swaps for the Newly Frugal will show you five quick things you can do right now to start saving money to add to your new Emergency Fund.

16. 💸 Tips and Tricks for Saving

19 Tips and Tricks for Saving drives you to the most important areas of cutting back expenses in your home budget. These are the quick and frank lists that will provide a gentle nudge of a reminder on things we should be doing.

17. 🥘 Inexpensive Freezer Meals

Freezer Meals are a secret weapon for busy families! 20 Slow Cooker Freezer Meals for Beginners has a great variety of recipes to start freezer meal prepping and see the savings come along.

Bonus One! Start out by using the Monthly and Yearly Financial Goals Worksheets! Write down your financial goals…this is the first one and writes out how you plan to achieve them. In this post, we showed you how to set up goals that are realistic and attainable. It all ties together!

18. 👛 No Spend Challenge Printable

Use the No Spend Challenge Printable to help you quickly start to save. By putting you and your family on a strict budget for just 30 days, you are able to capture money that would normally be flowing outside of the home via eating out, extra groceries, parties, girls night out and more. Stop the spending for 30 days to create the Emergency Fund needed for your home.

19. Start Using Money Tracking Apps

If you are still pen and paper, that is fantastic! There are ways to combine them both and using money tracking apps like Mint and YNAB are going to help you see right away where your money is going. The truth hurts so be ready for a wake up call when you start using these top Money Tracking Apps for 2022.

20. 💵 Start Using the 31 Page Savvy Budget Planner

You are now knee deep into finding ways to save so you may as well print off the Savvy Budget Planner and start overhauling your finances. It’s not time to quit since you have progressed this far.

Now that you have 19 BIG WAYS TO SAVE, it’s time to start documenting it all on your tracker and putting it into a true savings account.

💻 Snag Your Copy Here

For personal use only

You are ready to jump-start so print off the printable and let’s get started saving right now. Let us know how you did and how it worked for you!

Related Articles

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

nice artikel..

Thank you so much! Hope you enjoy the tools, tips and tricks! 🙂