Deciding to take control of your finances this year is the best decision you can make! Use this Free Mini Budget Binder to help you pull everything together in one spot.

No matter how you look at it, if you are landing on this page, you are dealing with money and finances for your household. I also suspect you are here because it’s hard, and you might need a little help and inspiration.

No worries! We’ve got you covered with everything you need to get started. Whether you are fresh out of school or are coming here a little later in life, it’s a great time to start getting in control of your household budget.

💰 Why This Works

All the Basics – We’ve pulled the basics of home budgeting together and left all the fluff out. This mini binder is set up for those that are ready to go all in right now without a lot of extras. When you master these essentials, check out our full 100+ Page Budget Binder. It comes with an insane amount of useful tools that will help you achieve your financial goals!

Free – Who doesn’t love free? You will get all of the basics to get you started on your financial journey.

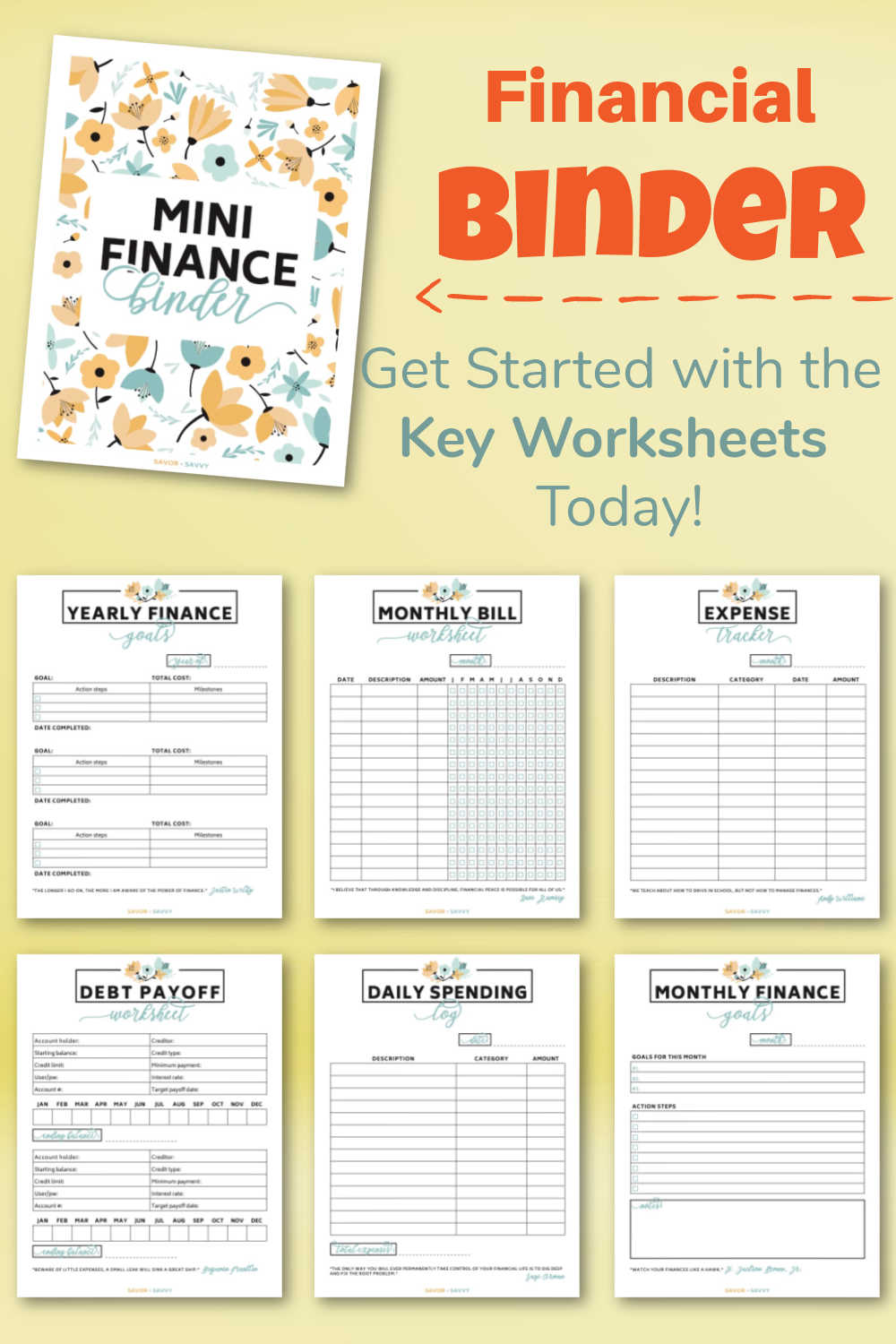

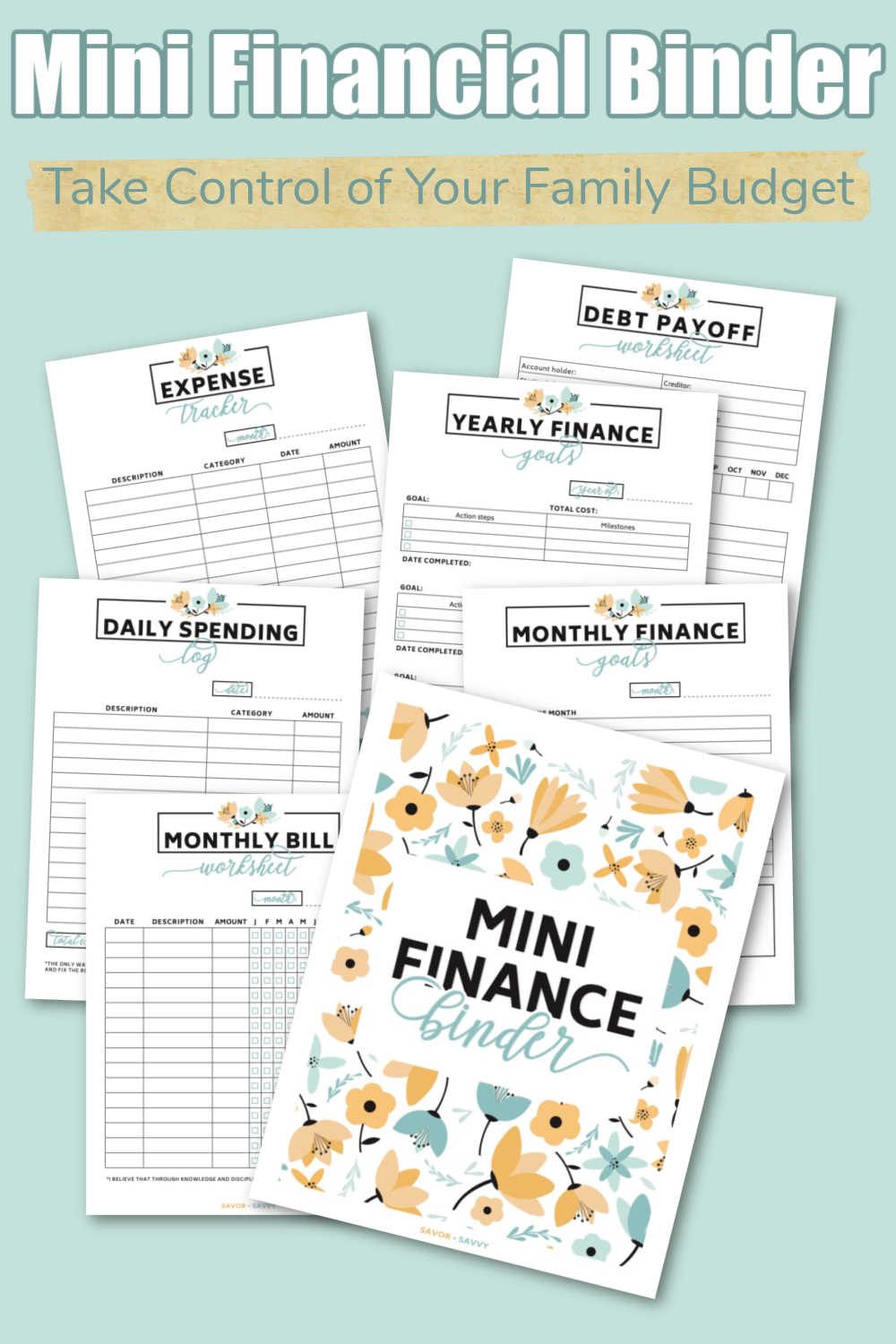

📝 What’s Included

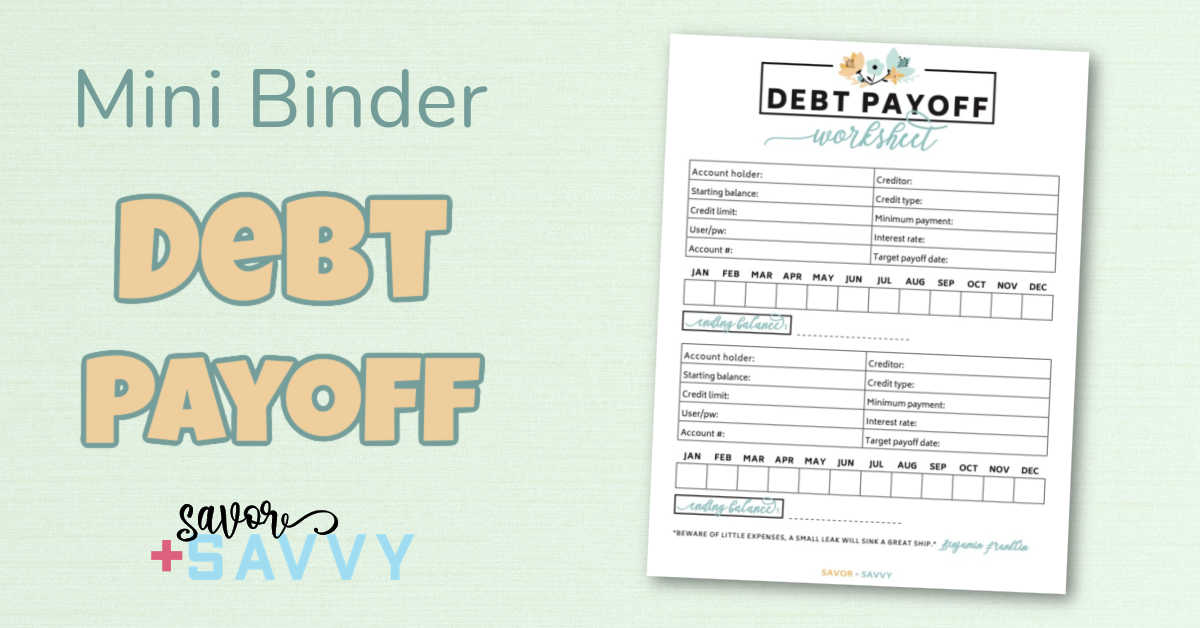

Debt Payoff Worksheets

Print off as many of Debt Payoff Worksheets as you need to record and log all of your debts. This might be tough to see, but it is a critical step.

This is a good time to account for cars, loans, student loans, credit cards and personal loans. If you don’t log everything, you won’t have a clear picture of what you are facing.

Monthly Bill Worksheets

Track your monthly bills with your Monthly Bill Worksheet to make sure none of those pesky ones slip through.

How many times have you sworn you paid a bill, but you accidentally missed it, and you had to pay a late fee? This worksheets let you check off the bill and the month so you know for certain they are paid.

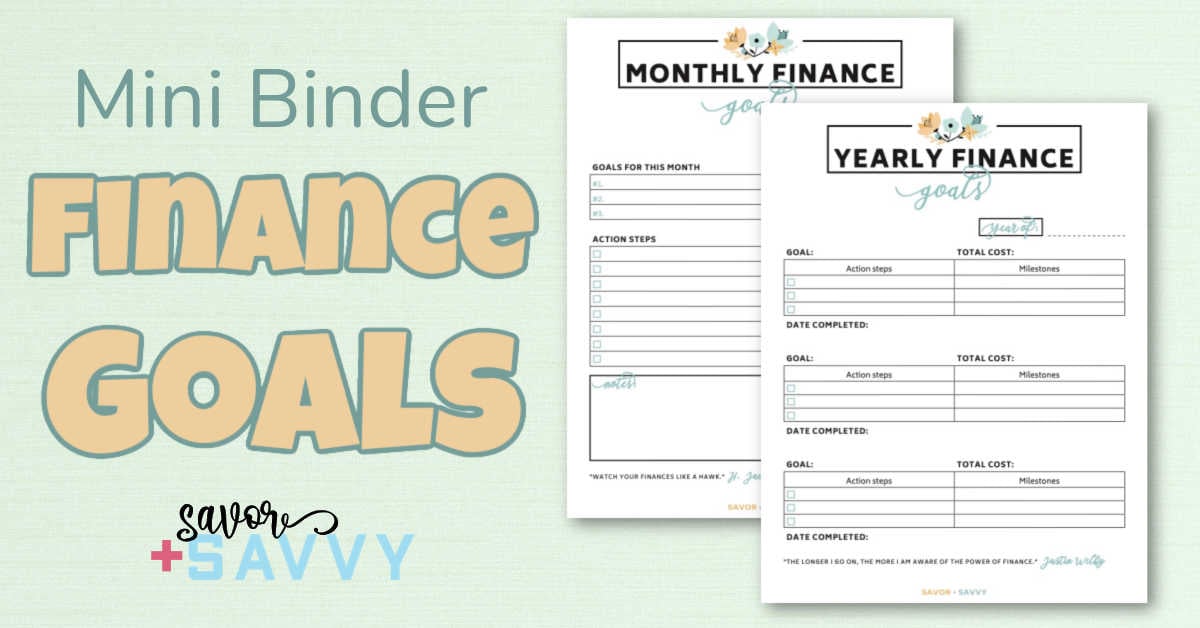

Financial Goals

Take time to fill in your Monthly Financial Goals each month. Fill in your goals and the actionable steps you will take to make these happen.

An example would be to find an extra $50/week to save. The actionable steps would be to cut out coffee houses at $5/day so that is $20-35/week right there. Look for other savings to meet that goal.

Break out your Yearly Financial Goals and develop three actionable steps to make it happen. Record your milestones for each goal. Keep track of the milestones as they will keep you motivated and on track towards achieving your goal.

If you don’t track the milestones, it will become too easy to just forget about the goal and say it didn’t work.

An example would be to cut $5000 debt out in the upcoming year. The actionable steps would be:

- Cut back eating out to once a week

- Cut back on cable tv services

- Move Girls Night Out out to being an at home event where it is potluck or something that is less costly than going out.

The milestones will be:

- Saved $243 in the first month.

- Saved another $706 by meal prepping my breakfast and lunches.

- Eliminate $15 a month by cutting out XM Radio.

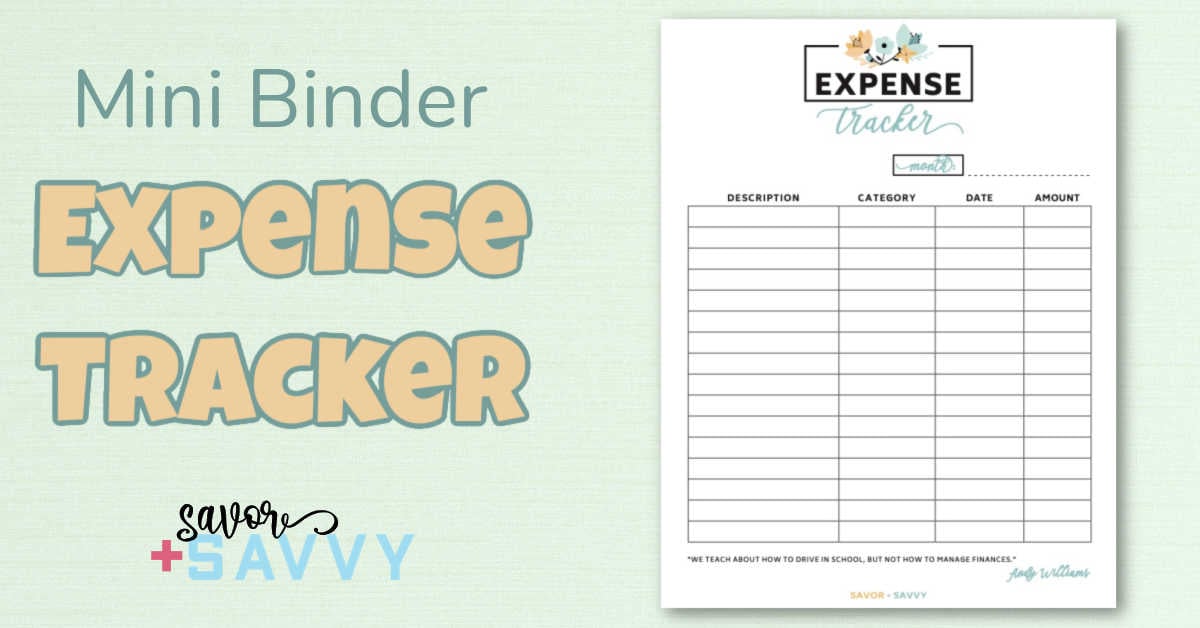

Expense Tracker

Start off by logging in all of your expenses on this Monthly Expense Tracker. This is a great way to quickly see “oh my gosh, I didn’t realize we spent $xyz on this!” and you can look to see if there are ways to cut that expense back going forward. It’s all about seeing your decisions on paper.

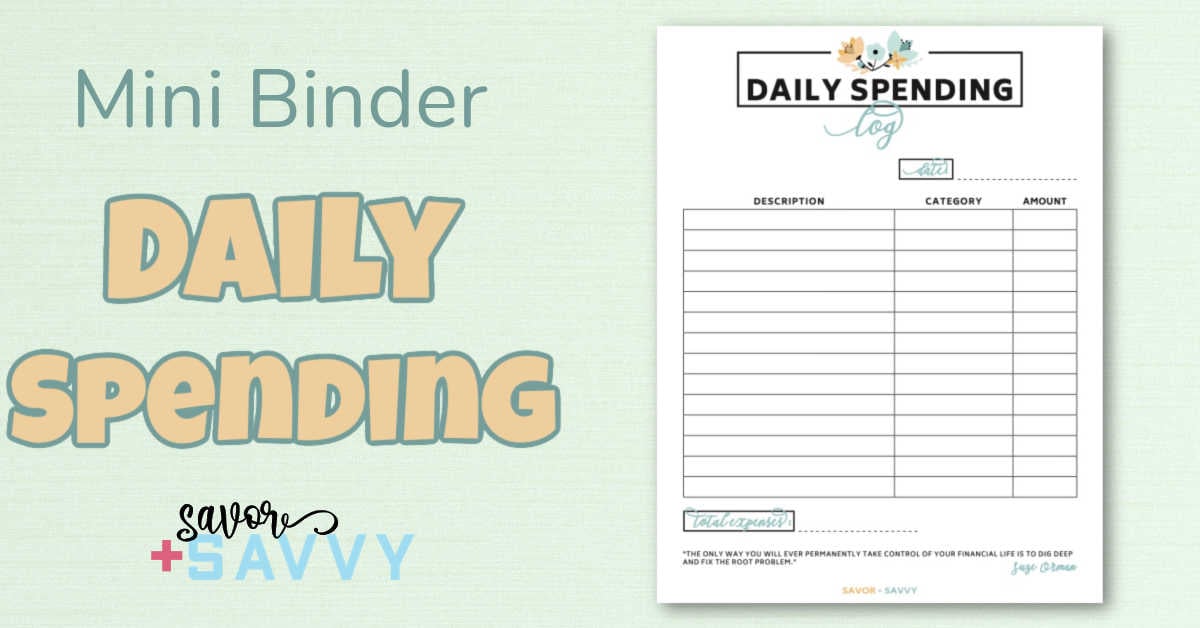

Daily Spending Log

We talk about recording Daily Spending in a Log all the time because it is one of our all time favorites. This is the time to start finding big bucks to save! I get very excited because everyone always says this is the most powerful tool to help you change how you look at finances.

If you want to find where your money goes, I assure you, this is the one page that will make the biggest difference. You have to track everything though and be honest with yourself. So, if you send a friend $12 on Venmo, record it here. If you bought coffee for $6.23, that gets added too. Did you donate $20 to buy things for your child’s classroom? Yup, you get the idea!

Personal Note: I am wicked passionate about Daily Spending. I tell the story where an embarrassing amount of money went to Starbucks and Target.

I was a huge volunteer at school and scouts and once I started tracking my volunteer spending, I found I spent a lot of money on things the school or unit needed. So, they got my volunteer hours and my money. At some point, you have to say “no” to things and all of this came crashing down for me about the same time. I felt like a cat chasing its tail getting nowhere fast and I was done. So I just ask you to use the Daily Spending

Log as we all tend to spend way more than we actually realize and it is eye opening.

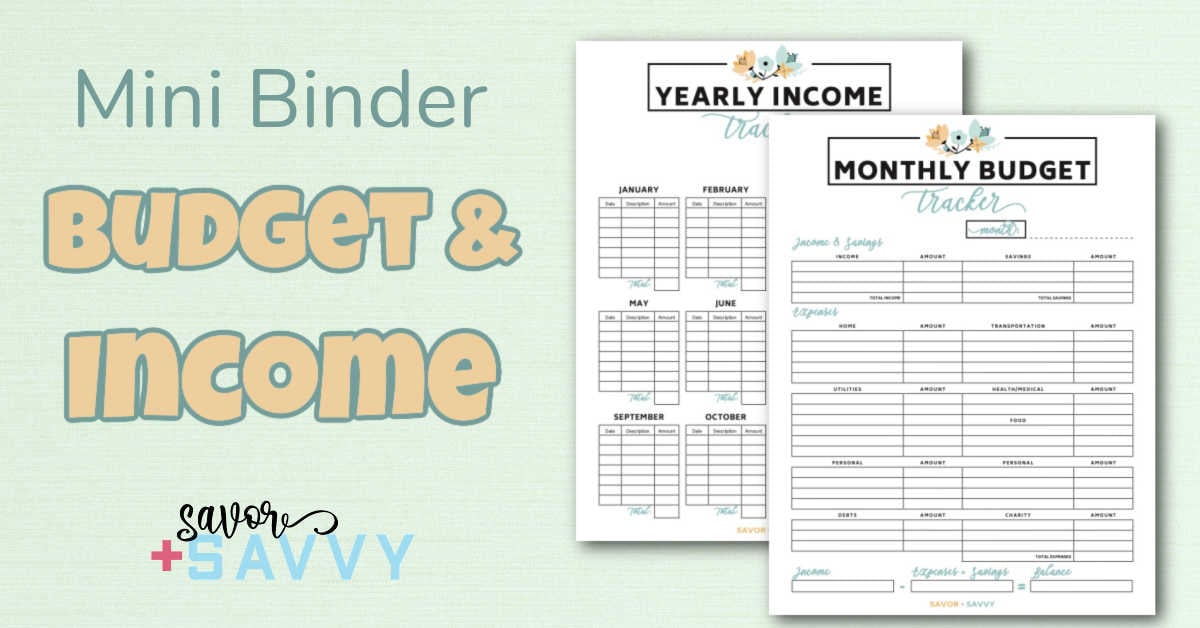

Yearly Income Tracker

This is your opportunity to track 100% of all your income that comes in your household all on one sheet. This is so important to use as so many of us have many different ways that we have money come into our budgets and we can quickly forget about those side hustles like babysitting or freelance projects that aren’t consistent.

Look at this as a way to see if your income fluctuates each year which can help better plan the budget. If you are paid hourly, there may be times through the year that you know you will get overtime for an extended period of time or if you get a yearly bonus, you can track when that comes in.

Budget Tracker

It’s hard to fill out any of the above sheets if you don’t have an idea of what your monthly budget looks like. In this sheet, you will write down all of your income and all of your expenses. At the bottom of the sheet, you will subtract the expenses from the income to get balance. Ideally, this is the balance that you will work from for groceries, clothing, and all the extras in life. Don’t be too shocked when first starting out budgeting, those numbers are ugly. Keep moving forward towards positive results.

🖨️ Print and Use

Step One: Print the Free Printable Mini Budget Binder. Print out all of the pages and place all of the sheets in a binder so you can easily keep track of everything in one tidy spot. If you don’t do this, it becomes a mess and we don’t know where to locate everything. Start off strong by printing them out and placing them in a binder.

Step Two: Fill out the Debt Payoff Sheet. Fill out Monthly Budget at the same time.

Step Three: Fill out Monthly and Yearly Goals and know that they can change.

Step Four: Start filling out the Daily Spending on Day One!

Step Five: Review your checkbook and credit cards to fill out the Expense Tracker and the Bill Tracker.

Step Six: When you’ve mastered these sheets and are ready to move on to additional useful tools, check out the Ultimate 100+ Page Budget Binder. This is a comprehensive binder that will help you take your budget prowess and shift it into overdrive!

What happened? Analyze what happened to your financial life when you started using the tools. What changed? What worked? What was your biggest challenge? How can you fix it?

Related Posts

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

Leave a Reply