The Mint App is the ideal budgeting tool or the everyday budgeter. If you are new to budgeting or looking to update your current strategy, this tool will revolutionize your approach.

If you consider yourself to be a laid-back budgeter looking for a simple and straightforward way to get your finances in order, the Mint app is your best bet. Out of all the money management apps available, Mint is one of the most well-known and trusted, for good reason. Best of all, it’s free and only takes a couple minutes to set up an account. Let’s dive into all the details so that you can get started.

💰 Introduction

Mint is a free money management tool available for iOS, Android, and desktop users. It links to your bank accounts, credit cards, debit cards, loans, Paypal, and even connects with bill payments to effectively track all incoming and outgoing money.

Mint is a part of Intuit, which is also the creator of Turbotax and Quickbooks and is used by over 20 million people worldwide.

It’s popular for its ease of use and takes less than two minutes to set up for most folks. It offers a variety of features, such as giving users the opportunity to check credit score for free, create savings goals, sending alerts before you go over your budget, and offering an automatically updated glimpse at all of your account information in one place.

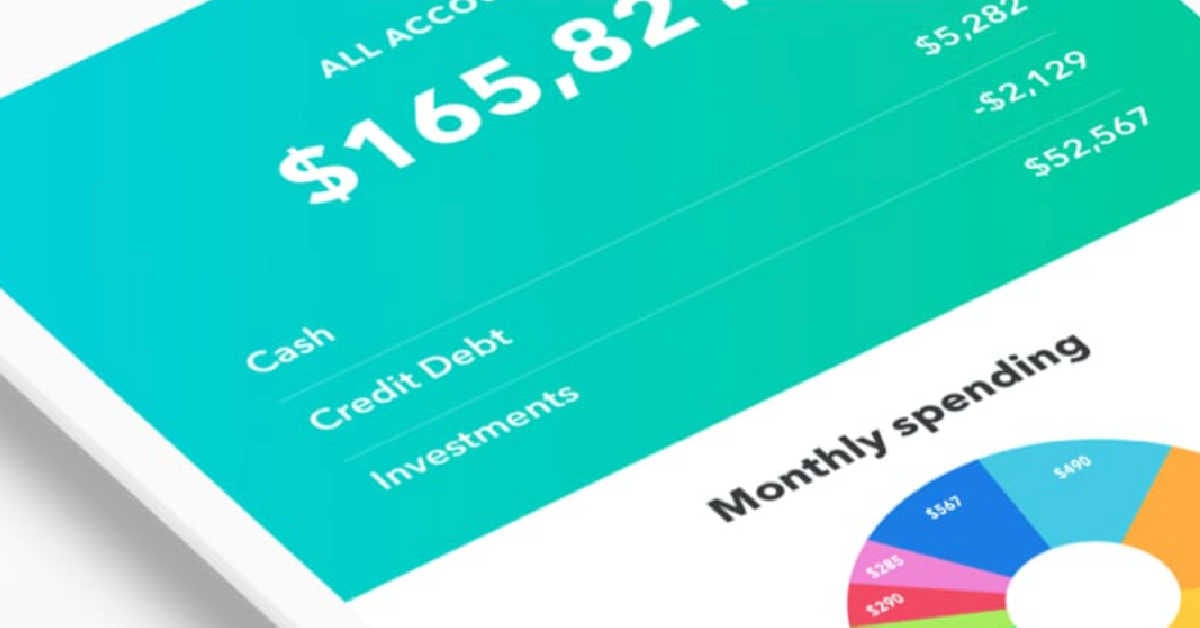

The aesthetic and minimalist interface is designed to give users a simplified overview of all critical information using graphs to depict financial information.

💲 Overview

The most obvious reason why this is so popular (aside from the glitzy user interface) is because it’s free. It is great for budgeting, tracking expenses and investments, monitoring credit scores, bill management, tax reporting, and tracking custom categories for your expenses.

The software is secured using two-factor authentication to protect your sensitive financial information.

It automatically updates your incoming and outgoing money so that you receive a live look of all your account information each time you log on.

Key Features:

- Weekly summaries

- Credit monitoring

- Money advice

- Budget alerts

- Synch your accounts

- Custom expense categories

- Tax reporting

- Bill management

- Investment management

- iOS, Desktop, etc

- Set goals!

💸 Features Not Available

Unlike some other personal finance apps, you can not pay bills or cancel subscriptions. It is also not specifically designed to go into a lot of depth with managing investments, but it does offer a basic investment tracking feature which works well for monitoring. Users can not use the app for retirement planning, importing QFX or QIF files, or reconciling transactions.

In short, these are the things it does NOT offer:

- Cancelling Subscriptions

- Bill Payments

- Retirement Planning

- Importing QFX or QIF Files

- Reconciling

- In Depth Investment Tracking

🏦 How to Use

Signing up for a Mint account is easy and just requires creating a strong password and then verifying your identity using a code sent to your phone number. That’s all it takes to create an account and then the app will direct you to the user dashboard.

📱 Link Accounts

This is the most vital part of setting up your account. In order to accurately track your expenses and start budgeting, you’ll want to link all of your financial accounts to have them in one place.

Step One: Start by linking your primary bank account. It’s easy because it will be the first thing you see once you’ve signed in. Simply click on “Link an account” and then select your bank.

Step Two: The prompt will then ask you to sign into your bank using your personal account sign-in details. It will also give you the option to link other accounts at this point. The app will then load your information so that it is displayed on the homepage of your account. From here onwards, it will keep your account numbers automatically updated as you add or spend money.

💵 Budgeting And Tracking

Budgeting and tracking expenses is essentially what this is all about.

Budgeting is simplified and automated since the app syncs and categorizes expenses into predefined categories. This allows you to track and categorize what you spend to give a quick look at where your money goes each month and helps you understand your spending tendencies. Create your own subcategories to track expenses at a more granular level.

Since it automatically categorizes expenses, we had two costs that didn’t get categorized how I expected. It wasn’t a big deal, as I made the adjustments manually.

💵 Set Goals

The goals feature makes creating goals (and sticking to them!) a breeze. Set specific goals like setting aside a certain amount each month for savings, saving money for a trip, getting out of debt, etc.

Just click on the “Goals” tab and then click on the icon for the type of goal you want to set. The app will give you step-by-step instructions for the goal. That’s it! Setting goals has never been easier.

💰 Track Spending

The app automatically tracks all of your transactions broken down in a simple-to-understand, categorized format. This allows you to see an updated list of all your expenditures at any given moment.

Scary, right? Once you get over the initial shock of seeing where your money REALLY goes, this is quite liberating!

Set up a variety of different alerts to keep you on track and to prevent you from making money-related mistakes. This feature will likely end up being one of your favorite things offered because it is so helpful for really sticking to your budget and avoiding slip-ups. You can set up alerts for bill reminders, making large purchases, late fees, and going over your budget in a category.

If you are old school, you may like to see your expenses on a sheet of paper. We have a free Expense Tracker Printable for you to use. I use it in addition to the app.

💵 Monitor Credit Score

It is easy to check and monitor your credit score. On the homepage of the app, you’ll see the option that says “check credit score.” Initially, you’ll have to enter some basic information to allow the app to calculate your credit score. The app updates it every month so that you’ll always know where you stand.

The credit score page of the app is designed to give users an easy-to-understand glimpse using colored graphs and bullet points. It gives you details as well, such as the percentage of your on-time payments, your credit usage, and the average age of your credit.

🏦 Investment Tracking

Mint offers portfolio-style investment tracking tools to help you stay on top of your investment accounts. The tools help detect hidden and unnecessary fees as well as advice for making your investment funds grow more effectively. Compare your portfolio to market benchmarks and view your asset allocation for your 401(k), IRA’s, mutual funds, and brokerage accounts.

📎 Safety and Security

Inputting your sensitive financial details into an app tends to stir up a lot of questions, the main one being: is this safe?

Luckily, Mint is known for being ultra-secure and is trusted by millions of users. The makers of Mint also built Quickbooks and TurboTax which you have likely used before. It uses multi-factor authentication to protect access to your account and uses VeriSign to ensure security when transferring sensitive data.

📒 Budget Binder

Ok! You’ve made it this far! The Mint App can definitely help you get a handle on your budget. It is free and helpful – which is a recipe for success!

If you want to take that experience to the next level, check out our Budget Binder Printable. I want you to be successful and I would love to help you to take control of your finances this year.

📱 Common Questions

One of the main conveniences of using a mobile app is the fact that it is available anywhere you have your smartphone on-hand and a data or Wifi connection. However, if you are not keen on getting yet another app, use their services just from your desktop browser at Mint.com. A desktop app is also available for added convenience, meaning you won’t even have to use your browser and search bar to access it.

Mint currently only supports banks and financial institutions in the United States and Canada. So, as long as the banks are American or Canadian, you should be set.

One of the biggest questions asked by prospective users is if the app can be used to manage joint finances. While it doesn’t have the ability for couples to merge their accounts (yet), there are ways you can address it.

There are essentially two options for couples wanting to use Mint to manage their shared finances.

The first option is to create an entirely new account, which will be a shared account, and each person links their personal financial accounts to it.

The second option is that one person uses their existing Mint account and adds the other person’s financial accounts to it.

YNAB and Mint are both fantastic budgeting tools but they are very different. The difference mainly lies in how much the user wants to be involved in the budgeting experience. YNAB is much more hands-on than Mint and requires more time and engagement. Mint, however, is ideal for offering an all-in-one glimpse of your personal finance situation with minimal effort. Mint is free whereas YNAB is paid. Mint offers free credit score monitoring which is a feature that YNAB does not offer.

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

Leave a Reply