It took me a while to figure out how to crush my long-term debt, and let me tell you…it’s a daunting task. I had some help from these free printable debt snowball worksheets, and they can work for anyone!

This isn’t the only debt payment system out there, but it’s certainly a tried-and-true one. I can’t help but mention the debt avalanche method as well. I’ll explain how the snowball method works and the differences between them so you can make the best choice for your needs!

꩜ How The Debt Snowball Method Works

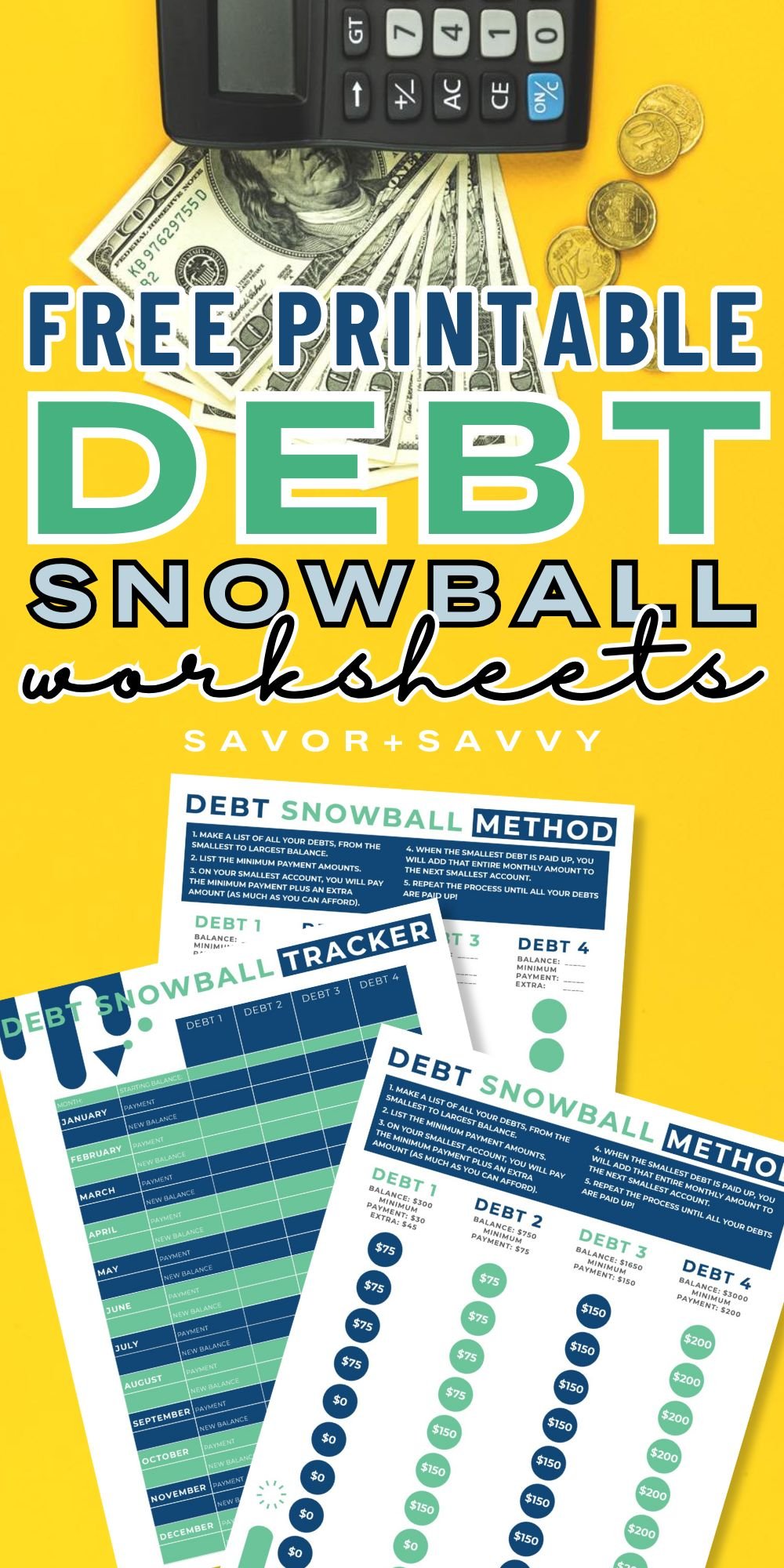

This printable set includes two worksheets to help you track your debt payoffs.

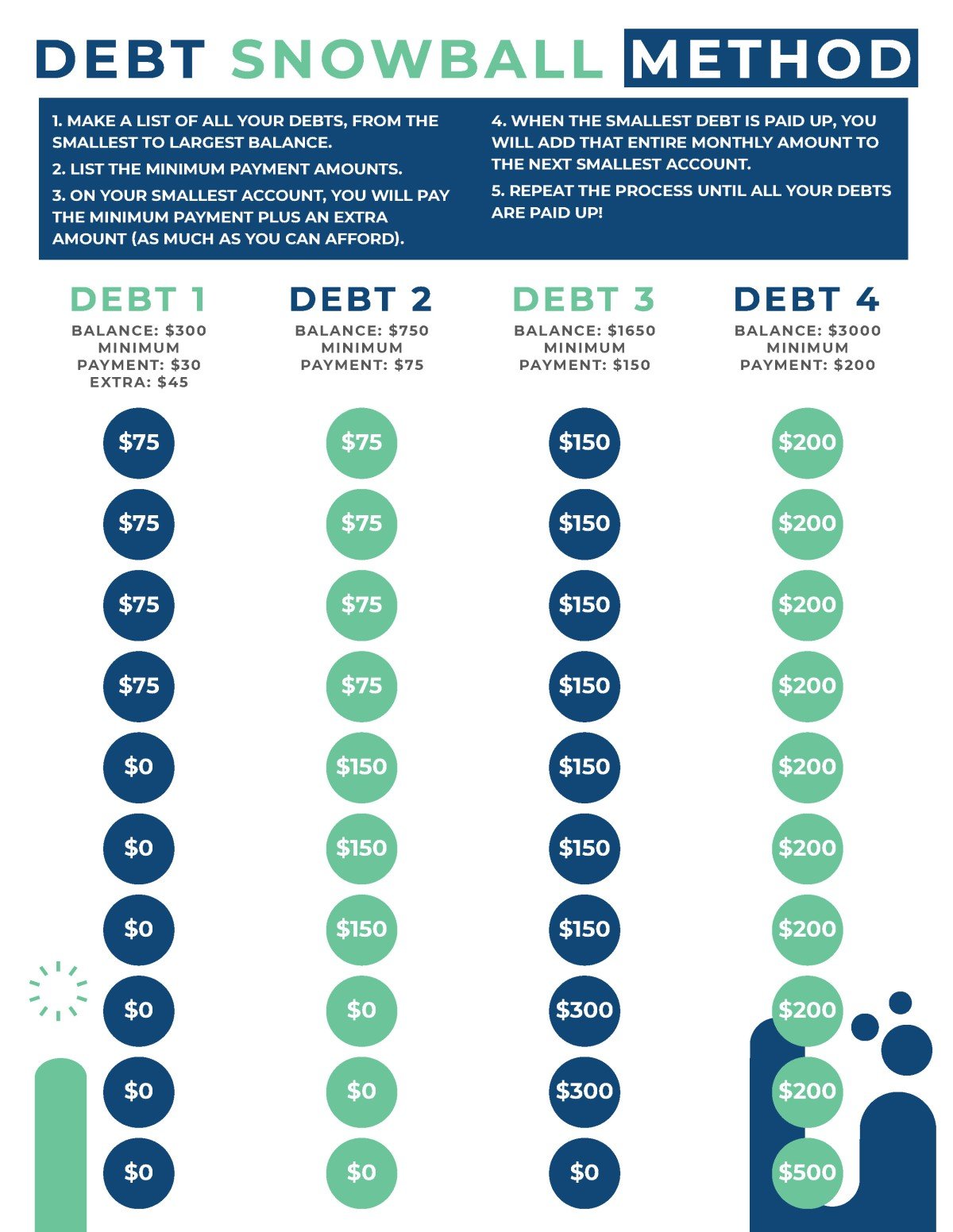

👉The debt snowball method has you paying the minimum amount due on each debt you have, with one exception. The SMALLEST dollar value debt you owe (credit card, card, etc.) will receive ALL of the excess money you have left after paying the minimum. Sound confusing? It’s not once you see the example.

👉The reason this method for paying off debt works so well is rooted in psychology. The idea is that you will get excited when your debts get paid off faster. If you focus all of your energy on paying off the smallest debt, you will eliminate it faster and will see the benefit more quickly.

👉Once the first debt is paid off, you move to the new SMALLEST debt you have, and you will apply minimum payments to all other debts except this one. Rinse and repeat until you are debt-free!

It is called a snowball method because you will be paying off your debts faster and faster which is similar to rolling a snowball down a hill. The more it rolls, the more snow it picks up and before you know it, you have a huge ball of snow!

💰 Printable Debt Snowball Worksheets

Now, let’s talk about what pages are included in this free collection and how you can use them to apply the debt snowball method.

Debt Snowball Method Example

You can see how in the example printable, Debt #1 is getting SNOWBALLED first as it is the LOWEST balance. It will take four months of regular payments plus the extras to pay off the $300 balance (we are not including interest payments here for ease of demonstration!).

On the 5th month, Debt #1 is paid off! Woohoo! Now, Debt #2 is the next smallest debt and will receive all of your available money. You’ll be putting even more on Debt #2 each month now that Debt #1 is gone. And, like a snowball, the pattern continues faster and faster until all your debts are gone.

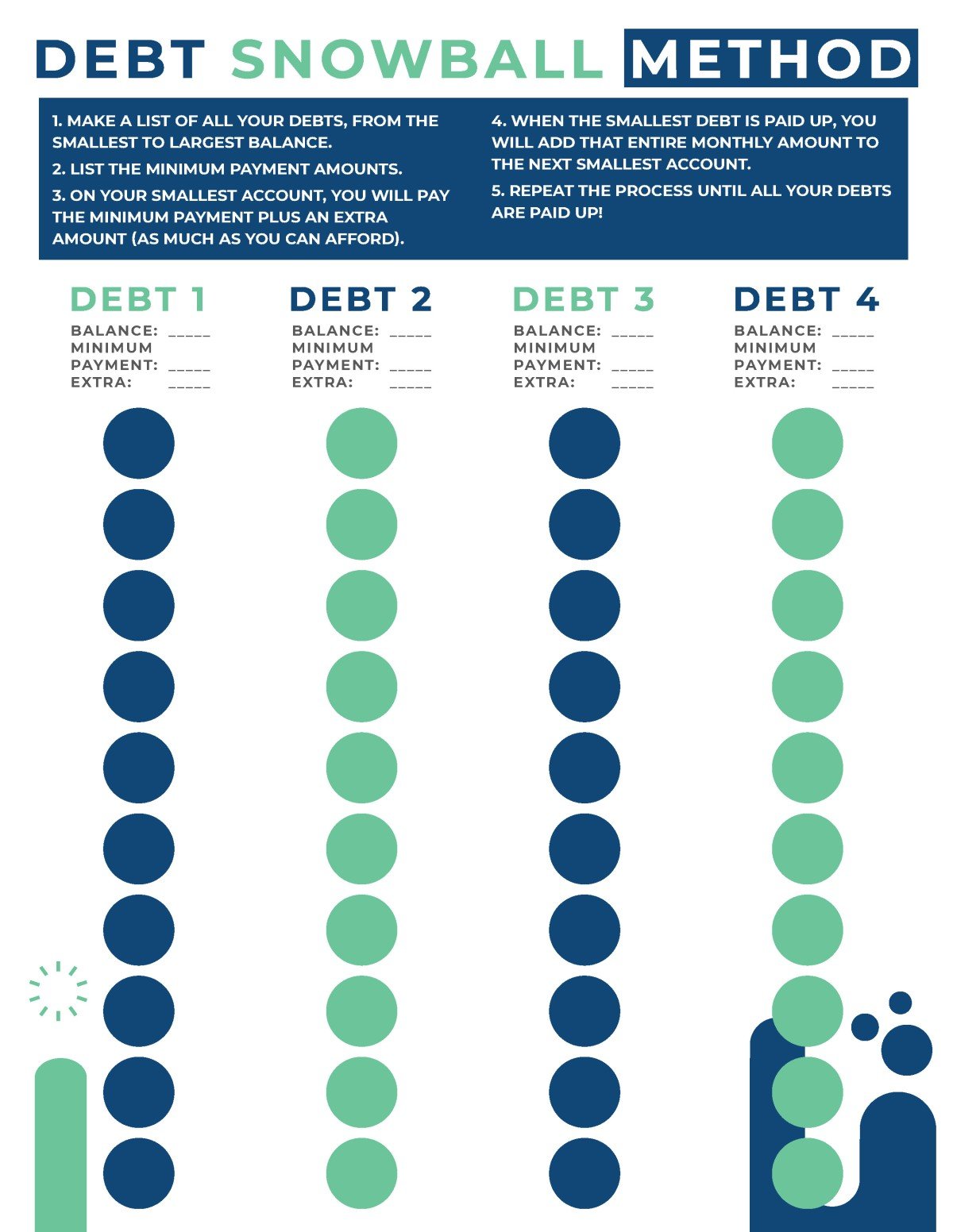

Debt Snowball Method Worksheet

Now it’s time to fill in the blank debt snowball worksheet and put it to work towards paying off all your debts. Make sure to update at least weekly!

💡Tip: I keep these sheets in my budget binder, next to the free printable monthly and yearly finance goal trackers. Trust me, you need to set up those goals. It helped a lot in keeping myself responsible.

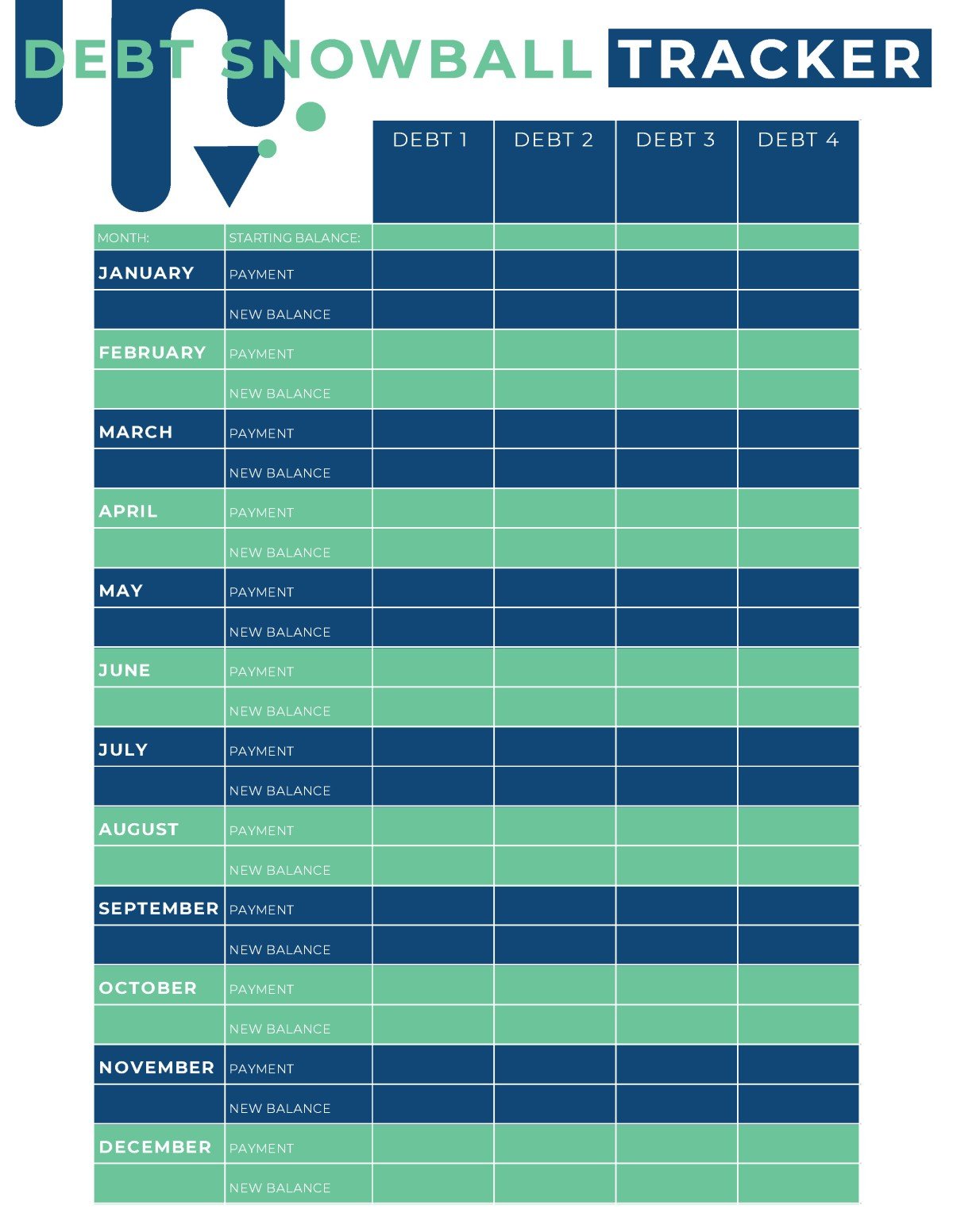

💵 Printable Debt Snowball Tracker

The tracker is where you will list ALL of your debt on the top line and keep track of it on a monthly basis. You will be able to see your debt decrease each month as you record the balances.

🏦 Snowball Debt vs Debt Avalanche Methods

The debt snowball method pays off the lowest balance debt you have first. This is great for someone who needs to see a reward quickly, irregardless to the amount of interest being paid.

The debt avalanche method pays off the debt with the highest interest rate first. You can read more about it and grab my free printable debt avalanche worksheets if you want to give it a try.

There is a lot of debate on which technique is best, but the right answer is that you should choose which one is best for you and your family. The end goal is to get out of debt, and both techniques let you do that.

💸 3 Steps to Start

✔️Gather all the budgeting/debt/bank information from all of your accounts. This is going to take a bit of time, and it is completely understandable. You’ll appreciate investing your time to do it right the first time. If you are feeling overwhelmed, it’s ok. It’s completely normal and just remember you are AMAZING for taking this brave step to get out of debt!

✔️Download the MINT app. This will pull in all of your financial data into an app, and you no longer have to worry about missing a $3 payment on a credit card you hardly ever use. It might be eye-opening when you get this set up, but once it’s done, it’s done. You are brave enough to do this, or you wouldn’t be on this page with me today. You can do this. Download the app and pull in all the data. There you go.

✔️Create a Budget Binder. Yep, I’ve mentioned this before but you really do need to empower yourself to use ALL the tools available. If you want to do the snowball debt tracker and yet you keep charging new adorable shoes on the other three high-interest credit cards, what is the point of it? You are going run in circles is all.

My free printable mini budget binder gives you all the tools you need to curtail your daily spending, monthly expenses (oh, did you forget about that monthly $9.99 charge each month??), and so much more.

You’ve got this! You just have to accept what is done is done and address how you are going to make changes going forward.

🖥️ Download the Printables

💵 Easy Ways to Cut Your Budget

There are always ways to cut our budget, no matter who we are. Rarely can we all sit and say “yep, I’m as low as I can go!” The reality of it is, there are things you are paying money for each month that you don’t NEED and this is a great time to recapture some of those funds to put towards your Debt Snowball.

- Check to see if you can decrease your cable bill? Call and ask if there is a better option for you. We did, and the company miraculously “had a deal” for us. Sheesh.

- Check to see if you are renting a router from your internet provider. I didn’t even realize that we were spending $15 per month on renting it. I went online and bought one for $60. That is an amazing four-month payoff!

- Are you using ALL of the streaming services or can you cut one or two out?

- Can you decrease your internet bill? Call and ask if they are running specials.

- How many music subscriptions are you using? Can you cut it down to one or simply eliminate them for the sake of paying off debt?

- Can you downgrade your cell phone coverage? Change plans or providers. There are constant changes in this market so just because you called six months ago, doesn’t mean that offers aren’t available now.

- Look at your bank. Are you paying fees that you could be reduced?

- Call your car insurance. Have them do an audit and see if they can reduce your bill.

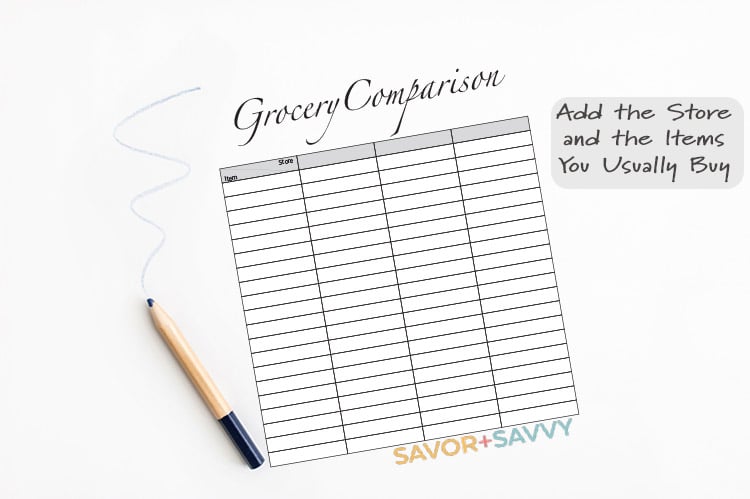

- Use the grocery comparison chart. I was amazed how much money I saved on my weekly grocery bill just by writing down the costs of my normal groceries.

- Do you make a meal plan for the week? If not, start doing that NOW. There is a grocery list here as well! It is scary how much money you will save by planning your meals each week.

- Re-evaluate expensive drinks out. That could be coffees or cocktails. You can catch what you are spending on your daily spending log! This is most likely going to be your biggest eye opener!

- Bring a sack lunch into work. I have a great list of meal prep lunches here for you!

- Eat meatless one to two days a week to bring down your grocery budget.

- Extend your haircuts to eight weeks instead of six. I know, I know. But try it and see if you can make it work.

- Stop getting pedicures in the winter when your feet are covered or only get them in the summer months. You are looking to cut back here, and this will save a few bucks.

- Use the library rather than buying books.

- Make sure you have done everything to cut back on your water and gas bills.

- Check out your gym membership. Are there specials? Are you using it? Be honest here.

- Check on digital services like monthly app purchases or automatic payments being charged for newspapers, magazines or anything like that. You are looking for those sneaky $2.99 charges that we all ignore.

- Start a no-spend challenge with your family. Use what you have for 30 days and see how much money you can save!

We have to set goals to start your journey! Best of luck, and I know you have THIS! Stay strong and believe in yourself!

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

Would you have A5 or A6 sizes soon or will these be the normal Page size only?

So far, this is it. I love requests though (that’s how a lot of our printables get out there!) so I’ll go research!! Thanks so much! Ginny