This No Spend Challenge is going to take your normal budget and crush it!

The No Spend Challenge is a hard-core approach to cutting back. It is set up for anyone who is ready to take control of their spending and saving, whether you WANT to or HAVE to. If you are here, you have probably already been tracking your money via a budget but are ready to be more aggressive to achieve your goals for financial success.

Getting your entire family on board is key here. One person can’t change the habits alone so it’s best to have family meetings to discuss this to make sure everyone is in alignment.

💵 What is it?

No Spend Challenges are set up to have you not spend money on anything except for bills for 30 days. Seem impossible? Some people start with weekends or a shortened period of two weeks. Depending on where you are on your financial journey, you may want to try out a mini No Spend Challenge. It is a great way to get a taste of a full 30 days!

I found most of our family’s spending happened on weekends when we ate out due to convenience or lack of planning. I always felt like that was wasted money. So, I had the family try it just for weekends to see if it was possible. Spoiler alert: It totally is!

Determine the rules for what you are allowed to buy. Obviously, you need to keep paying your bills, and you shouldn’t shortchange things like medications, but it is reasonable to cut off eating out, video games, coffees, and virtually anything purchased online. These rules are unique for each family, so spend time to agree on what you can and cannot accomplish.

💰 The Benefits

The biggest benefit for most of us is the extra money that we will have in our checkbook after 30 days. To get an idea of how much that is, look back over your last 30 days and add up what you are disallowing for the challenge. I bet you’ll be surprised!

One of my favorite parts of doing the No Spend Challenge is being self-aware of spending. It only took us a short bit (not a full month even) to have our eyes wide open to our senseless spending. We didn’t even realize it. It is said that American’s spend on average $100 a day. Yes, this is the average, but it is a great starting point for all of us to dig deep and think about exactly how we spend our money. Using the Daily Spending Log you can track how you are spending your money. For most of us, it only takes a few days of writing down what we spend to see exactly what we can cut out. Bye Bye Caramel Macchiato!

💡10-15 Tips for Success

Let’s get you started with the best tips and tricks to help the next 30 days so smoothly for you and your family.

Save Money on Food

- Make a Meal Plan. This is huge! You can’t win a No Spend Challenge if you don’t plan. Start the month off buying your groceries based on the meal plan. Utilize #2 below before you go to the grocery store to minimize the amount you have to buy. Try to incorporate family favorites along with a few new frugal meals to stretch the dollars. It eases the change for everyone. Here are 10 weeks of Frugal Meal Plans to get you started.

- Go Through Your Pantry and Make Meal Plan Based. When making your meal plan, go through the pantry to see what you already own. When we did ours, we pulled out the two jars of Pumpkin Bisque I bought at Trader Joe’s a couple of months ago and didn’t eat. There you go – one meal down! My husband likes to buy canned oysters and sardines so we put that as one lunch for him. You will be surprised how much food you already have in your pantry. Fill it all into the meal plan in #1.

- Meal Prep Lunches to Take to Work. I add this as a separate item because too many of us eat out for lunch and that was a huge burden on my family’s weekly budget. When I saw on my credit card statement years ago that my husband spent $6 on something for breakfast and $12 on lunch, I knew I had to make the change. He didn’t love that food at all and so it felt like we lost out twice. I doubled down to meal prep his lunches and even do it before I go out of town to visit my mom. Do the math on that. $18 x 20 work days= $360 per month is what we would have spent if we kept that up! No, nope, nyet, nada!

- Make a List of Cheap Meals to Eat and Actually Eat Them. If you don’t already do this, research and make a list of cheap eats. When the challenge is over, incorporate 1-2 of them each week in your future menu planning so you can go forward with meal planning costing you a bit less than it was prior to the No Spend Challenge.

Cut Back on Retail Therapy

- Leave Money at Home. If you have to go out and about, leave your money at home. Credit cards included. Most of us don’t have that much discipline so it’s best to leave money at home all together. If you don’t have money to spend, it doesn’t matter how much you wanted the object of your desire.

- Unsubscribe to Email Lists. This is crucial! Don’t skip this step at all. This just leads to impulse buying. Do you really need the 40% off Groupon email? No, you don’t. You don’t know what is on Groupon so why do you need 40% off? Can you see that logic at all? Stay off email lists – period.

- Don’t Visit Any Retail Websites At All. Just like the email lists, stay off of all retail sites during your no spend challenge. This is not the time to window shop and dream up what you should buy.

- Don’t Go to the Store. If you have to pick up items, go alone and when you are not hungry. This isn’t the time to wander Target to just “see what they have” or to take everyone on a quick run to the grocery store to grab milk. If you need milk, go in and grab it and get out. Put your blinders on and focus on your goal for the challenge. “Gathering” is the enemy of the No Spend Challenge.

Find Fun Projects to do

- Make a List of Projects Around the House You Wanted to Accomplish. We all have them! Those projects that we have “meant to do” all these weeks and months but something always came up and it never got completed. This is the time to knock out all those projects! Vacuum vents, deep clean blinds, go through your closets for donations, clean cupboards, deep clean carpets, bring out the steam cleaner and do the cloth chairs you have been avoiding. Our family does all of these and more. This is the time I deep clean and soak laundry and even get down to clean the grout in the tile. Since these are things I have been wanting to do anyways, it doesn’t feel like I’m being cut off on spending. I do donation runs (if gas is on my rule list!) and even break out the bags of paperwork I need to shred. My latest project was to clean out my Recipe Binder as it was just exploding and falling apart.

- Dig Out Things You Have Already Purchased To Do and Haven’t Had “Time” to Do Them Yet. I love this one. It is my favorite! I look at No Spend Challenges as time to read those books I bought, but never read or sand and stain boards I bought to make a table. I look at it positively that I am given this time and I can use it to address all those things I have purchased but haven’t gotten around to doing yet. Here is my time! I love it!

- Take a Free Online Course. This is a great time to jump start learning something new! This is just one site that offers classes online for free for you to take this No Spend Challenge month and come out the other side a little bit brighter! https://www.classcentral.com/collection/top-free-online-courses

Fun Frugal Activities

- Revisit Family Favorites That Don’t Cost Money. Sit back and think about what family activities that you all enjoy that don’t cause you to spend money. Our family loves to hike and bike so we tend to do both of those a lot! We also love to play games, so that is high on our list. My son and I will do a TV series marathon of a show we have wanted to watch but didn’t have time. My husband and I still go out, but we make it a frugal date night.

- Go Through Stuff and Sell It in Local Yard Sale Groups on Facebook or Craigslist. As you are cleaning closets and such in #4, look at what you can sell on the FB Marketplace or Craigslist. If you have a ton, you can probably do your own yard sale as well. We have only done the local ones and they always work to bring in decent money.

- Utilize the Public Library for Books and Movies Using Libby/Overdrive/Hoopla. Break out that library card and put it to good use. This is the time to revisit an old favorite or find something new. Also look at your local library for free events that you can participate in without breaking your No Spend Challenge.

⚠️ Other Frugal Ways to Support Your Efforts

- Use Up What You Have Creatively. Ditch paper towels and start using reusable ones, drink tea instead of coffee, use the food/drink items you received as gifts, reuse gallon zip lock bags like your mom used to do. You get the idea. One of my biggest things I like to do during a no spend challenge is to go old school and not use Clorox Wipes. I love them, but I need to use what I have and I can make a good cleaner at home to clean most spots without needing to go for my expensive wipes.

- Make Goals List, Print them and Hang them Up. We are all about making goals and a huge part of doing the No Spend Challenge is to set up goals that are attainable, yet stretch outside of your comfort zone. Read all about setting SMART GOALS here to help you determine the best approach for your No Spend Challenge.

- Grab a Couple Friends and Ask Them to Team Up With You So You Have a Built-in Support System. Be the first one to take the leap of saying “I’m doing a No Spend Challenge and here is how it works…do you want to join me?” I know it’s hard to do this, but you are going to be shocked at how many people just wish they had a friend to help them too. Nobody wants to do this alone and I get that – but grabbing a friend will ease the challenge tremendously. If you can’t find a friend to join you, make sure you tell them so they don’t tempt you to eat out or go to a festival.

🏦 Set Aside A Mini Emergency Fund

Just like with everything this month, set aside a Mini Emergency Fund (you will need to determine that amount) for true emergencies. This probably won’t be “the kids are annoying me, and I need a manicure” type of emergency. Things do come up and we need to address it. Just don’t fall into the trap of using the Mini Emergency Fund to pay for things “we just want” rather than need.

The good news is that you should have extra money you can set aside thanks to this challenge. I recommend depositing it in the bank as soon as you identify how much is extra. If it is out of hand, it will be out of mind.

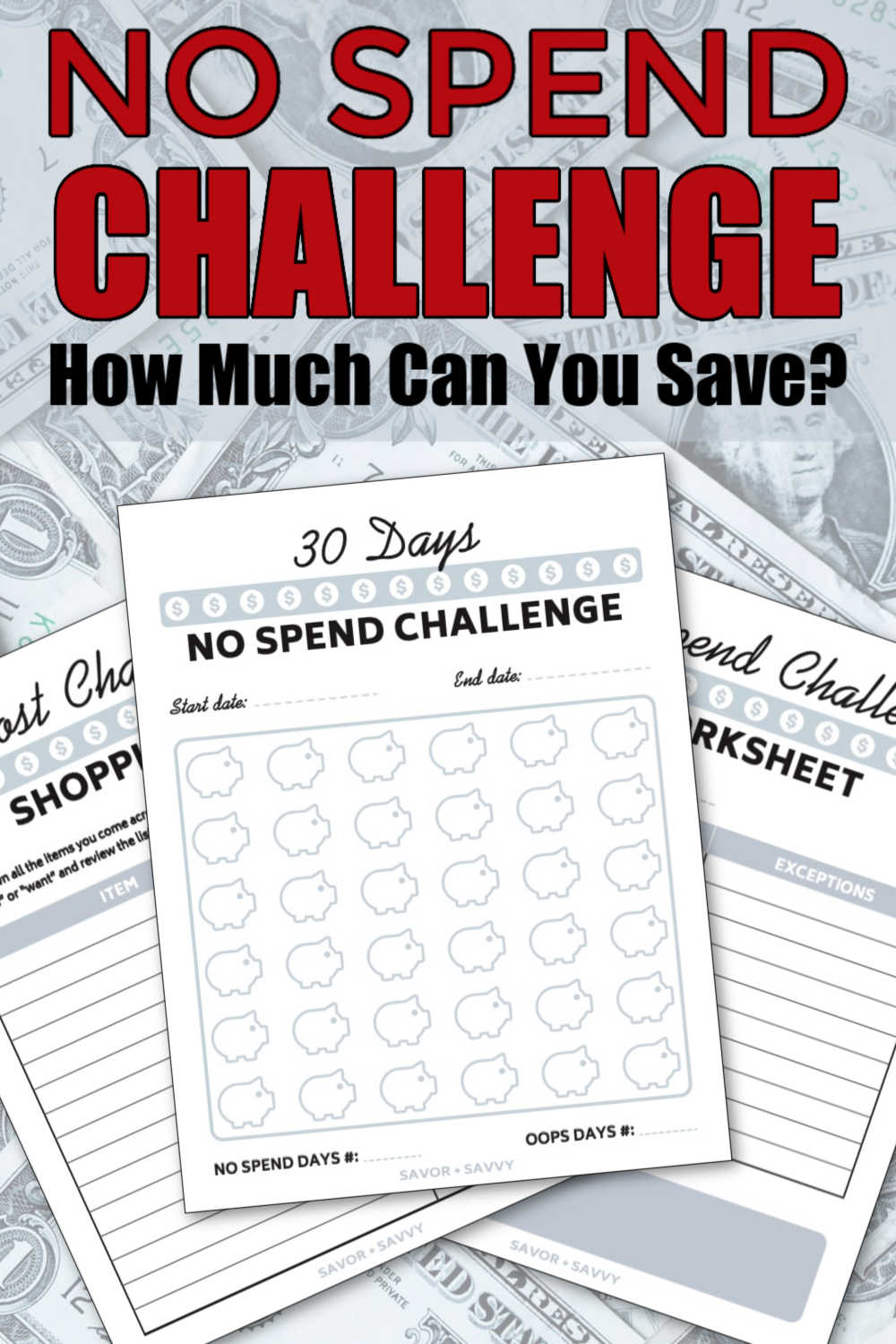

💵 Three Pages of Printables

There are three pages set up for the No Spend Challenge!

30 Day No Spend Challenge Page. This is your go-to daily worksheet where you will mark off each day that you made it through without spending! At the bottom of the page, you will mark off how many successful days you had and how many were less than successful or “oops” days. I like to keep these for future use so tuck them into your financial binder when you are finished and compare them to the next time you challenge yourself to a No Spend month.

Also, don’t worry if you aren’t able to spend $0 on a day. It happens. Don’t beat yourself up about it. Just buckle down for the next day!

No Spend Challenge Worksheet. This page is set up for you to write down your rules, and if there is an exception to that rule…write it down. At the top is the goal.

I am in the process of seeing if I want to expand this section of goals and would love reader feedback. Let me know if you want this section larger!

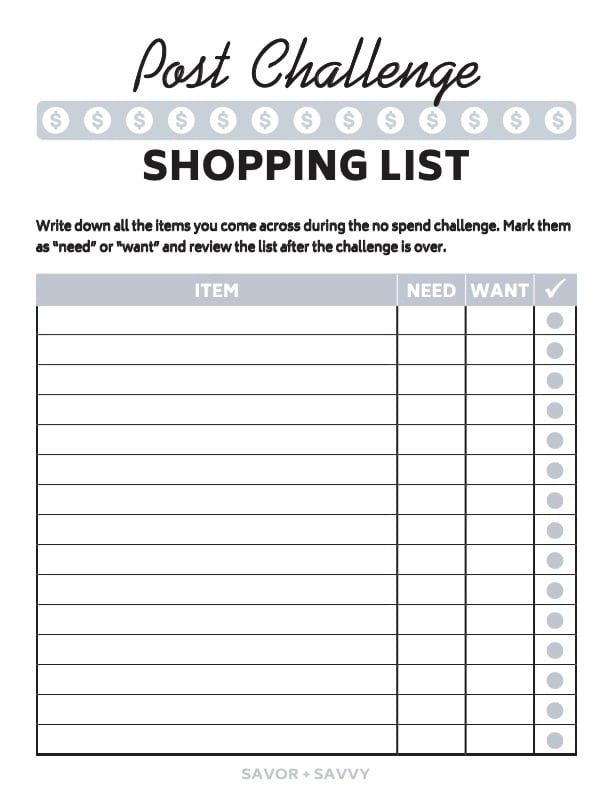

Post Challenge Shopping List. This worksheet can be addressed in a couple of different ways. I like to use it to track what I ran out of – they are all “needs” for me. I did add the “want” section because I think it is also good to add in things we have wanted throughout the month. It’s funny, but when I look back on my “wants” I find that I can easily live without it. Don’t skip this step. It’s important to see how your spending habits can change going forward.

🖥️ Grab Here

💸 What To Do With Money Saved

This all depends on what you chose as your goals to begin with. Maybe you wanted to save to pay off your car or pay down student loans. Maybe a credit card bill just got out of hand and you need to get it under control. Look back at your SMART GOALS you set up earlier to determine where the extra money goes. There is no right or wrong answer on where the money goes so don’t think of this as a judgement area. You could spend it for a vacation, anniversary or even Christmas. Do what works for your family.

💲Make sure to check out our other Financial Printables that go with this series!

$1000 Emergency Fund Challenge

Savings Tracker (coming soon)

Yearly Income Tracker (coming soon)

💲 Here are a couple of other fun challenges that you might want to start with:

🥄 Resources For Meal Planning and Shopping Lists:

Organizational Binder with Menu Planner

🥣 If you are looking for frugal meals, check out these:

10 Weeks of Recipes Frugal Meal Plans

39 Grocery Items You Can DIY Instead of Buy

📱Facebook Group and Instagram

📱 Facebook:

This is not my group but for anyone looking for a group support as they go through a No Spend Challenge, make sure to check out these No Spend Challenge Facebook Groups:

The No Spend Challenge Facebook Group

📱For Instagram:

Use #nospendchallenge and there is an incredible amount of support on there as well.

Using these social media resources will relieve any fear that you are alone doing this and in a lot of ways it’s pretty cool to surround yourself with people who have similar financial goals!

Let us know if you started and/or completed a No Spend Challenge! We would love to hear how it works for you!

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

Leave a Reply