The Debt Avalanche Method is a technique used to pay off your current debt starting with the highest interest rate ones first, irrespective of how much balance remains. Using this free printable as a guide for setting up your Debt Tracker allows you to pull you and your family out of debt and into financial freedom.

💵 Why You’ll Love This Method to Paying Off Debt

Goes Quickly | Because you are starting with the highest interest rate, you will get rid of the most expensive debts first.

Keeps You Motivated | Concentrating on one debt (and it is the one that charges the highest rate!) is empowering. It feels so good to get rid of them, that your next debt will be that much easier!

Keeps You Focused on One Goal | Because you are paying attention to interest rates at this point, it allows you to just pay everything except for the minimums on the other debts to this one. So you throw everything you’ve got all onto this one debt to pay it off. As the balance keeps dropping, you get excited which makes you keep paying off more.

💰 How to Use the Worksheets

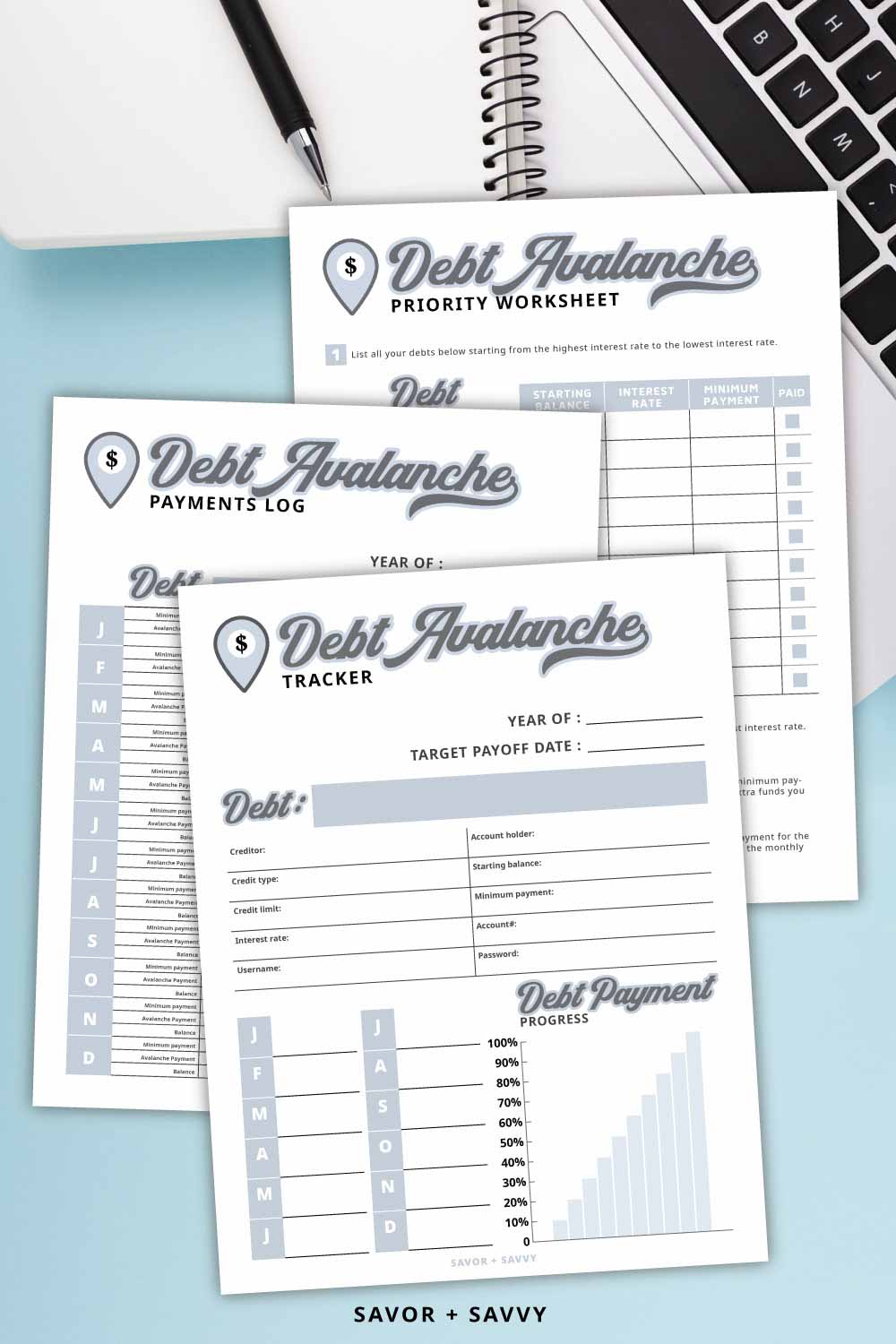

Step One: Fill in all of your debt into the worksheet (the one labeled PRIORITY WORKSHEET) starting with the highest interest rate to the lowest interest rate.

Step Two: Pay the minimum on all of your debts except the HIGHEST INTEREST RATE one. Apply all the extra funds you have to this debt to pay it off. Continue adding to pay it off until it is paid off.

Step Three: Continue paying off the debt that had the SECOND HIGHEST INTEREST RATE

Step Four: Use the Debt Avalanche until all of your debts are paid off.

💸 How to Apply This Method

Look at the hypothetical chart below.

Using the Debt Avalanche Method, you would make minimum payments on everything except for the Department Store Credit Card which has the interest rate of 21.9%.

All of your extra money PLUS the minimum needed on this card is what you would pay this month and going forward until it is paid off. The key, of course, is to stop charging so the balances drop fast.

| Debt | Balance | Rate |

| Car Loan | $18,400 | 3.5% |

| Chase Card | $5,700 | 9.9% |

| Discover Card | $2,600 | 18.9% |

| Department Store Card | $4,200 | 21.9% |

This is also a great time to re-evaluate your monthly expenses as well. Look deep into what you are spending and see if you can cut anything out to accelerate the debt avalanche. Plan your financial planning days on the 2024 Yearly Calendar so you don’t miss a day.

💰Snowball vs Avalanche

This one can be confusing because at first glance, they both seem to be very similar, but they are attacked differently and I’d like to show you how.

The Debt Avalanche focuses your energy on the debt you have with the HIGHEST INTEREST RATE first. You will continue to make monthly payments on all of your debt first and then follow up by adding any additional money you have to the HIGHEST INTEREST RATE debt.

The Snowball Method focuses on paying off the SMALLEST amount of debt first without regard to interest charges.

If you were using the Snowball Method, you would pay off the Discover Card first because it has the smallest balance at $2,600 and then move on to the Department Store Credit Card next. You will still make the minimum payments on everything except for the debt that you are currently attacking with extra payments.

💵 How to Choose

Both methods work. The best one financially is the Debt Avalanche as you are paying off the highest interest rate debts first. The Snowball Method is the best one psychologically, as you are cutting out one debt right away and you can feel “ok, I only have a few left!” and is excellent for those needing small victories! Kellogg School of Management did a study in 2012 and found people were more apt to stick to the budget when they saw personal victories of paying off a debt, even a small one, and sticking with the plan.

Our family has tried both versions when we used to carry debt. The key takeaway is that you DO SOMETHING to get rid of that debt.

🏦 10 Ways to Cut Expenses and Apply the Savings to Reduce Debt

By using just one or all ten of these ideas, you can cut a massive amount of hidden charges each month that can be applied to your Debt Avalanche! How much can you save?

Cut Out Multiple Streaming Services

Can you get by with eliminating Hulu, Netflix, Amazon, HBO or the CB streaming and save $15-50/month? Maybe just use one per month and switch them off and on. Yes, this is sacrificing but you are putting the savings towards your current debt!

Challenge Your Cellular Phone Provider

Are you paying for more data and voice than you use each month? Hidden savings can be found by simply calling the cellular company so they can tell you if you are eligible for a reduction. We saved $30 per month by changing plans.

Cut Music Streaming Services

Think about the car, computer and phone. People have plans for all of them. We found that we only needed one subscription service and knocked $10 off our bills each month.

We also realized that we were ok with listening to a few commercials and opted to enroll in the free streaming service just to save the money.

Scared to See How Much You Spend Eating Out?

Put yourself in check to see how much you are eating out when you have a refrigerator full of food. Actively plan for a day of week to eat out and make it special, rather than throwing money at restaurants because you aren’t feeling like cooking.

Eliminate Expensive Take Out Coffee

Taking out coffee is a huge one for people to eliminate quickly. Each coffee at a specialty shop is about $4 and if you multiply that by the 20 days you work each month that is $80. That might not sound like much, but if you took your coffee to work and applied that money to your debt, it makes a huge impact. Once you get into the swing of taking your own java, it is simple to knock this one out.

Find Free Activities

Ask friends to do low cost/no cost outings with you instead of the Beer Festival that is $40 a ticket to just get in and you still have to buy beer (but, I am not bitter at spending my money on that!). I’m not saying to never do this, but you can have a great time with your friends for a lot less money.

Trust me, they will appreciate being asked and getting a break with their finances too. I can’t tell you how many friends are relieved when I explain I don’t do “girls night out” at expensive places. The conversation is the same regardless of where we go and we all saved a ton of money! Try it!

How Often Do You Use the Gym?

Ask yourself if you are actually going to the gym and using it and/or if there is a cheaper/equally great option for you.

Magazines and Digital Services

Is there anything you can think of in your digital subscriptions that can be cut? Kindle Unlimited, monthly magazine subscriptions, digital photo services? Call each one and cancel the renewal before it hits your credit card. Look into anything digital you pay for. Performing a deep dive on the credit card statements will reveal all the charges.

What Else Can You Find to Cut Back?

This can be a house cleaning, mowers, dog groomers, etc. What can you take over and save the money?

Hair, Makeup, Nails and Spas

I saved this one for last as it is a sensitive subject for a lot of people, but it is expensive to keep up on all of these. Which ones can you REALLY do without? Can you go eight weeks between a trim instead of six? Do you NEED all the products you are buying, or is there something you can get that is a wee bit cheaper? You aren’t on a monthly massage treatment, are you? Unless this is for medical reasons, this can easily be cut out. I can go on and on for this section but it is a huge area that can be looked at to cut a ton of cash.

💲💲Make sure to check out our other financial printables to help you and your family reach financial freedom!

Mini Financial Binder is a great binder to start working on your finances and tracking your spending. Print out all the sheets here!

20 Budget Printables is a great one stop shop to check out other ideas to help you gain financial strength.

No Spend Challenge is set up to help you go on a 30 day No Spend Challenge! Are you up for the challenge?

$1000 Emergency Fund Printable helps guide you through setting up your $1000 emergency fund! How much do you have saved?

52 Week Challenge is a family favorite for us! This is the challenge that really turned our entire family around in our finances.

🖥️ Snag the Worksheet Here

Fill out the form with your name and email and we’ll redirect you to a page to download. This is only for personal use.

Let us know if you tried the Debt Avalanche and how it worked for you!

Use Monthly Calendars to Track Spending

March Calendar

Related Articles

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

Leave a Reply