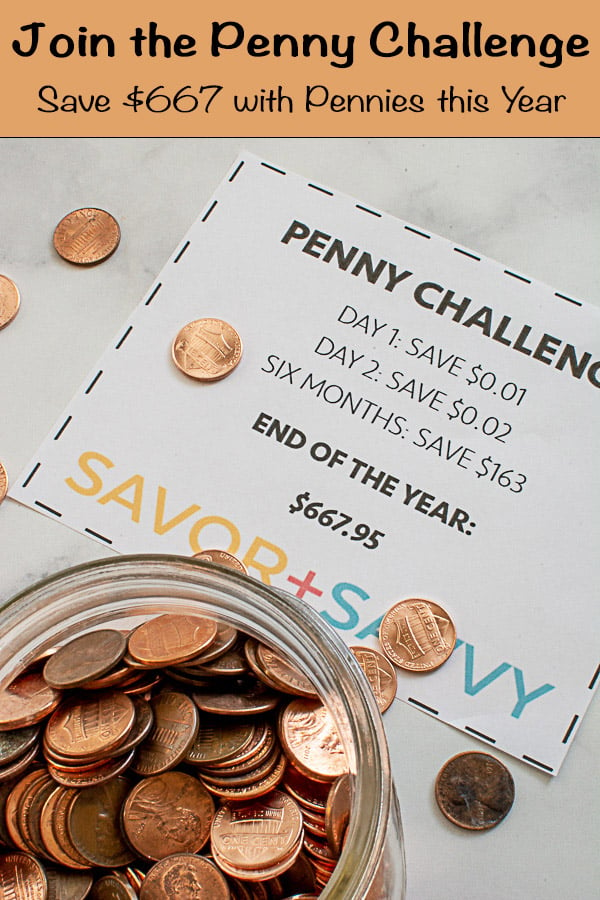

Use this one-year Penny Challenge printable set to save almost $700 in just pennies alone. This is a challenge that is set up for everyone to experience success in savings.

Did you read the 52-week money saving challenge last week and say “oh my gosh, I can’t do that!” and move to another post? If that seemed too intimidating, then maybe start a bit smaller with the Penny Challenge?

Included in the Penny Savings Challenge are the Incentive Cards!

These little cards are perfect for giving yourself a little High Five and Pat on the Back for working so hard to do this challenge. Remember, everyone is starting somewhere on the savings journey so you may need incentive cards.

💰 Why You’ll Love These

Small Incremental Savings | Using just pennies, this challenge is attainable by all with a small savings investment.

Feeling of Success | Without too much effort, you will start to see your savings grow without sacrificing much of anything on your everyday spending.

Great Holiday Savings | Challenges like these are ideal to kickstart your holiday savings.

💵 How to Use

Read up on Dave Ramsey’s methods, knocking down credit card debt with the snowball technique, and moving to a cash envelope system. All of these are amazing systems but many people need to start smaller.

The Penny Challenge is a fun technique to save almost $700 per year.

Step One: Start off the challenge by placing a penny in a jar. We can all find an extra penny to put in the jar, right?

Step Two: The next day, find two pennies to put in a jar.

Step Three: The day after, make it three. On the last day of the year, you will have added $3.65, making the total saved add up to $667!

All that for finding one extra penny a day!

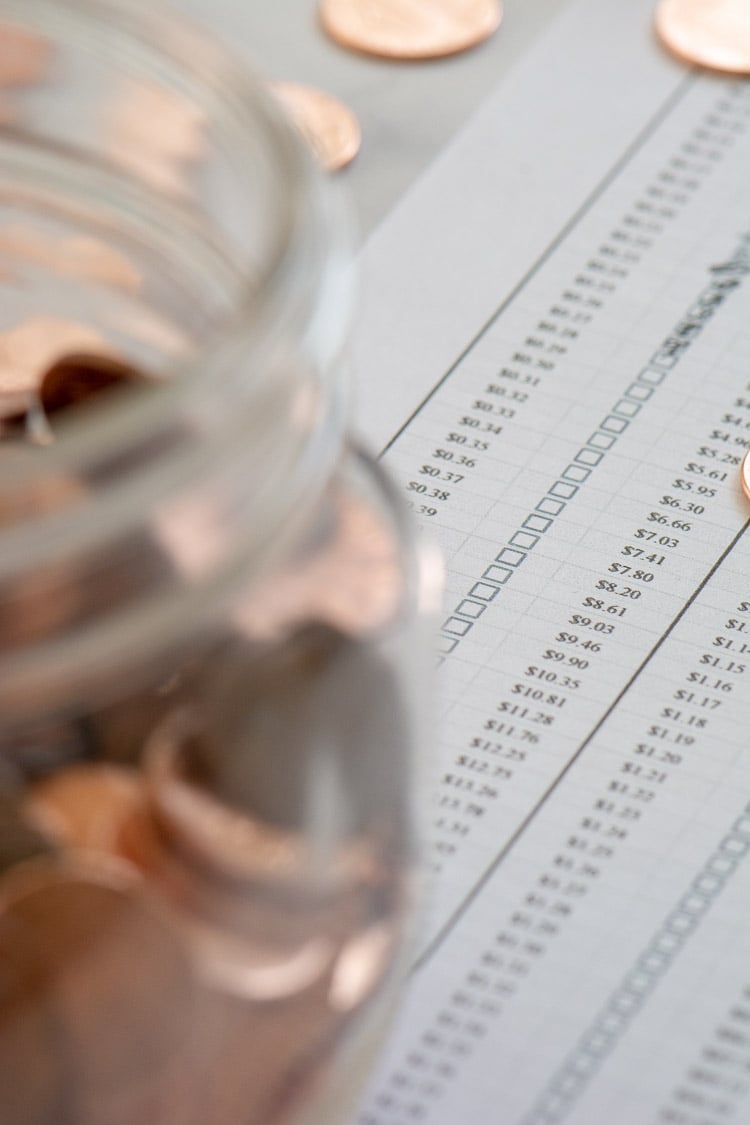

Snag the Free Penny Challenge Chart Printable

This one is one of the most used printables I have, and I use it every day to check off the boxes as I work towards filling this this year’s penny saving challenge.

Fill out your name and email address and we will get a copy to you.

What to do with the Incentive Cards?

There are several ways to use the Incentive Cards and I’m sure you guys will have several more as well!

- Laminate them and post them on a bulletin board or the refrigerator. Heck, you don’t even need to laminate them. Just post it as a way to remind yourself of the hard work you’ve already accomplished.

- Put them in your wallet next to your money as a reminder of where you have been and how far you have come. Maybe you don’t want to put your money towards another shirt and savings might feel just a tad better.

- Put them in your car so you can remind yourself to NOT stop at a drive thru or for an expensive cup of coffee every morning!

- Place them on or near the television set as a reminder of what you gave up to help yourself reach this goal. Did you dial back the cable tv? Remind yourself that you are doing this for a reason and be proud of that incentive card.

- If you are a clothes person, shoe person, make up person – it doesn’t matter…put the incentive cards there to remind yourself of what you are doing and to not tempt yourself with new shoes that you don’t need or makeup that might not be necessary right now.

💲 Top 10 Ways to Save that Extra Penny

How would you feel if you reached December and you had an extra $600 — CASH — stashed away with very little effort? Heck yeah! Sign me up, right? Your first few weeks of this challenge will be easy.

But, as you get towards the end of the year, you may need to make some lifestyle changes to save the few dollars per day. You have some time to think about what makes sense for you. Here is list of ways that we changed our daily spending to achieve that goal without much effort!

Prepare Meals at Home

Yep, this one is going to be one of the top ones because of how much it REALLY costs to eat out! I didn’t think we ate out that often, but I was embarrassed when tracked how many times in a month we were in a rush and stopped by a fast food joint to pick up a quick burger. SCARY!

Don’t try to go cold-turkey. I doubt many people can completely cut off eating out. Let’s start with just one meal per week. Yup, cut out one meal per week and it is possible to have all of your pennies saved! Do the math! $15 meal x 52 weeks = $780. So which meal do you want to cut to achieve this goal? Is that a reasonable behavior change for you? Cut out one $15 meal per week for the year and you’ve got it! We did this and it made a huge difference to our savings! How many times do you eat out per month? Be honest. Can you cut that back just a little?

Change Banks to Get Free Checking

The national average checking account fee is $10-12/month. Move to a free checking account, and you’ll save $120 for the year. It might take a few days to move your automatic payments and deposits to the new account (and that is not a lot of fun) but it can save a nice chunk of change, which can contribute to your penny challenge jar.

We will not go into talking about the fees for overdraft spending, which I hope none of our readers incur!! That is just throwing money away!

Get Rid of Premium Radio Subscriptions (XM Radio)

Sorry, XM! I think you are awesome and I love you but you are just way too expensive for music. My friends say “I can’t give up my XM!” Excuse me? Just a few years ago we didn’t even have such a thing. Yes, you can give it up if you want to save. It’s fine.

Make a choice but don’t say “you can’t give it up!” The average XM radio prices for the most popular plan of 140 channels is $15.99 per month. Give up XM at $15.99 x 12 months = $191.88/year. We did it. We now listen to NPR or free podcasts on our way to work instead of Jimmy Buffet radio. We doesn’t miss it at all, but we sure do like the extra money in our wallet!

Cancel Subscriptions

This will be humbling! Sit down with your bank statement and credit card statement and look over your recurring payments. What do you have on there? Netflix, Hulu, cable tv, Direct TV, hobbies – you name it. We all have them because it is so easy to sign up for the “it’s only $8.99/month!”

Before you know it, you have more than a handful and maybe you don’t even use all of them anymore! Cancel one or two of them. Be honest with yourself here. Let’s say you just cancel one (I am sure you can find more than that, though). Using the low end of $8.99/month x 12 months = $107.88/year This section can increase in saving drastically depending upon how many subscriptions you are willing to cancel.

Eliminate Annual Credit Card Fees

Are you paying an annual fee for them? Why? There are several available for no annual fee. Call your credit card company and negotiate for them to eliminate the fee. If they won’t, ask them to reduce your APR (that is another article altogether!).

You are looking for the lowest annual percentage rate possible for your credit score. For 2018, the average APR is running about 15%. Make sure you are not paying more than that. The more money you are not paying towards interest, the more money you have in your pocket! We’ll have another article about using credit cards, but the focus of this is just to eliminate the annual fee or lower your APR.

Price Comparisons for Groceries

Did I just get a huge groan out of you? I know, this really stinks. I’m not going to lie and say this is fun. This is where the serious savers go to add cash to your pocket! Are you serious about saving? This is what we do! I shop 3-4 stores over the course of 2 weeks and sometimes, even more, depending on if we make it to the Oriental Market.

I made a free printable to help you compare grocery costs. The results really surprised me!

Every penny counts in this game, and your weekly grocery bill is a large cost. Take the time to learn what the pricing is for 15-25 items that you regularly purchase.

Our family eats a lot of boneless, skinless chicken. It is almost always cheaper at Wegmans than it is at Costco. Surprising, isn’t it? You never know, so don’t go into these stores assuming anything. Every store will have loss leaders advertised just to get us in their doors. We know that, right? Just go into with the mindset that we are going to outsmart them at their own game!

I found 30+ items where I save money at Aldi. It means another stop for groceries every other week, but I save enough there to make it worth the additional time.

Stay out of Target and Walmart

If I didn’t hear a growl before about price comparisons for groceries, I know I will for this one! Sorry! We have to stop shopping as a hobby and get back to going to the stores to pick up what we NEED. I’ not going to entertain you with a meme about how funny it is that you went into the big box store for a gallon milk and ended up spending $200. Why is that even funny? You blew cash or credit on stuff you didn’t even think you needed when you went in. It has happened to me before, and I could almost get sick over it. It is best to just stay out altogether. If you have to go in, use a grocery list and be laser focused.

Make a List

Make a list for everything! Inventory your freezer items, pantry items, even daily meal planning. Become a list maker so you don’t waste. The list also helps you eat what is already in your pantry. We have some great lists right here on the blog to help you out for free. Print them out and start tracking! Once you start doing it, I assure you, it feels so good to not waste!!

Stop Throwing Food Out

Plan out your meals. Abide by those plans. Yes, things happen but they shouldn’t be happening every week. Did you have one piece of chicken left over? Put it in a container with vegetables for a lunch the following day. When you eat it, think IT’S FREE!!! Yes, that sounds crazy, I know. But once you start doing that, you will realize how much extra money you have to add to the penny challenge! Try it, it’s fun!

Make Your Own Cleaning Supplies

This saves so much money! We all get caught up in buying highly specialized cleaners and wipes. Do you really need the antimicrobial soap that smells like lemons? Would the plain bar of soap work just as well at a fraction of the cost? Scale back on one or two. It’s hard and I realize that going cold turkey on anything can be traumatic. Maybe you can use cloth towels instead of paper towels or make a homemade cleaner instead of buying one as a starting point and move ahead after that.

There you have it, my friends! 10 Easy Ways to Win the Penny Challenge! I know you can do it and I am almost certain that if you try it with these ways to save, you will save double or triple that amount! We’ve given you 10 techniques to save a few extra pennies to put in the jar! So grab an old jar, apply the printable and let’s make this happen!

Let me know if you are working on it and how it’s going.

If by chance this is too easy for you (which I would love to hear!) then jump over and start on the Game Changing 52 Week Challenge!

Related Articles

Grocery Comparison Chart – Take this to the couple of grocery stores that you frequent and do a quick analysis of the normal things you purchase and compare which store is saving you the most money! Takes less time and the results are shocking!

Free Monthly Budget Planner – This is a great tool to use to start planning out your family’s budget. The reason we run out of money a lot of times is because we are not planning because we think it is the planning that is stressful. Not knowing is the stressor! Plan it out and prep for the month!

19 Money Saving Tips for the Newly Frugal – Lots of great tips and tricks to incorporate into your financial goals! How many of these tips can you use right now?

$1000 Emergency Fund Savings Challenge – This is going to be the goal once you have achieved the Penny Challenge. After you see how much you can save so quickly, this one will come through a lot easier than you realize! Don’t be afraid of it!

Cash Envelope System – Dave Ramsey’s famous category envelope system helps you place your money each pay period into each envelope (included for free!) to spend for the designated period.

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

You mention staying out of Walmart, even for groceries? Walmart is better priced than Safeway and more convenient for me. If, you just mean to say be careful and not be suckered into the “deals”, that I can understand!

Christy, great question! No, I really mean that people use Walmart and Target as a way to entertain themselves rather than make a list, buy what you need and get out. When people use it as a means of entertainment, they buy stuff they don’t necessarily need and it’s just wasting their hard earned money. You’ve seen the memes of “I went into Target to buy 3 things and spent $200! lol” and it’s just not funny. That is what I’m referring to. 🙂 Ginny

I do have one note of caution about the penny challenge. When a person is ready to cash in all those pennies saved, DO NOT use the coin star machines found in stores. They take a huge percentage of your hard saved money. Hopefully, a person’s bank will accept the change in return for crisp paper money. Better yet, have it deposited into an interest-earning savings account! I am going to try the penny challenge in 2021!

Christy, you are right! We’ve only used Coin Star when I get an Amazon gift card as I get 100% of my money but then it isn’t CASH…it’s Amazon credit. So then I just use it to buy what I need and not just buy stuff. The best way is what you mention and that is going to a bank to trade it in. Love you and your idea of the savings account! Let us know how you like the Penny Challenge! We love it and have done it several years as we think it’s fun! lol!! Ginny

Thank you SO much for your time and generosity to create and share for FREE all of these resources. Bless you for your efforts ♥

Awww, Christa! I’m so happy you found something that can work for you! If you have more ideas, always drop us a line and let us know what inspires you! 🙂 Ginny