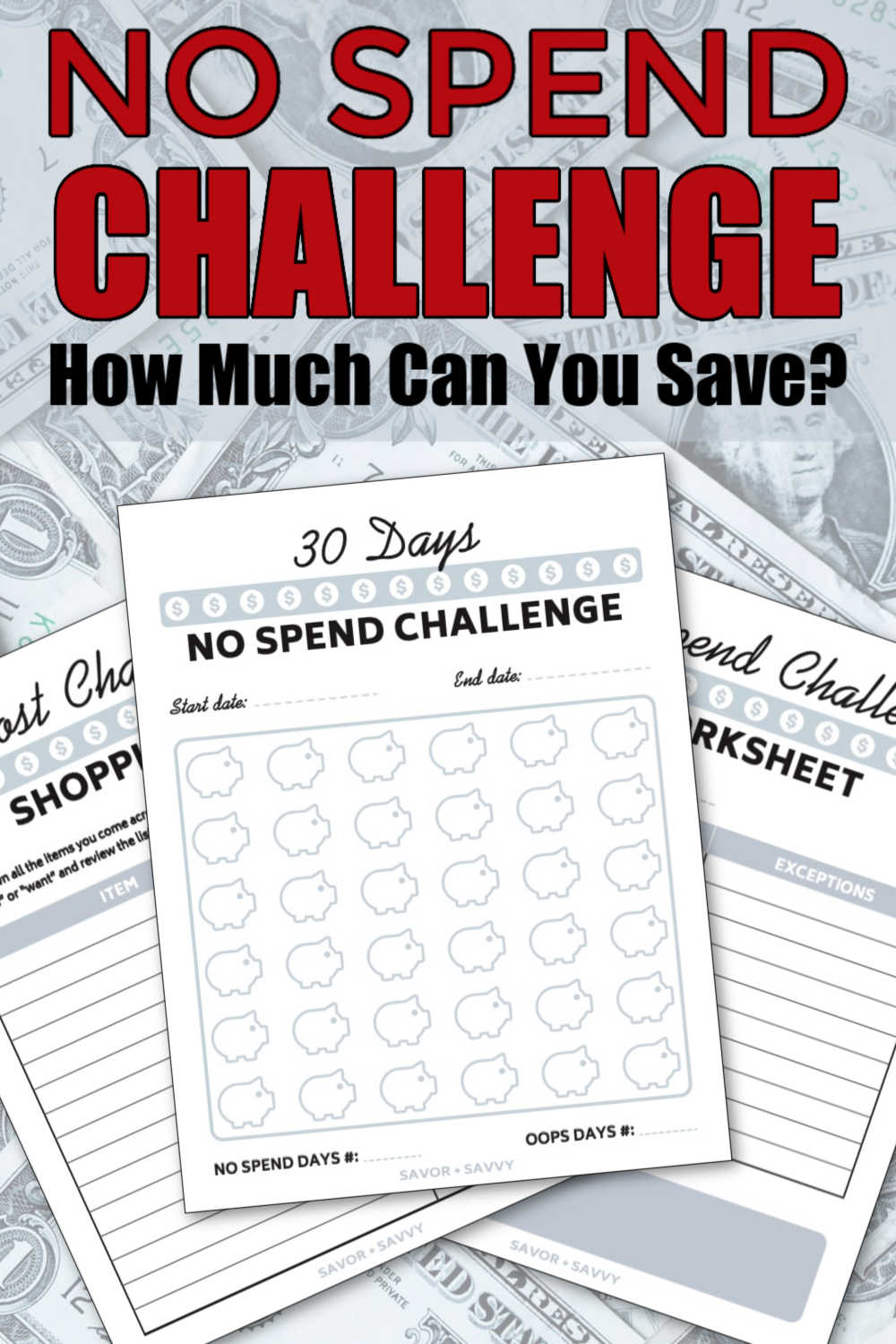

This free printable no spend challenge kit is going to take your normal budget and crush it!

For a long time, I’ve been easily tempted by all kinds of advertisements – there always seems to be something that catches my eye. With a bit of restraint, I was able to step away from these material distractions and save money in the process.

This free printable no spend challenge might seem like an extreme approach to cutting back. I promise you it is not.

❌ No Spend Challenge Printables

First of all, it is just one month, although it’s always nice if you can do this twice a year, even if not two months in a row (that’s a bit too restrictive, right?).

Secondly, I made it a printable kit to help you navigate through the month.

30 Days No Spend Challenge

There are three pages set up to help you tackle a restrictive month.

This is your go-to daily worksheet where you will mark off each day that you made it through without spending.

At the bottom of the page, you will mark off how many successful days you had and how many were less than successful or “oops” days. I like to keep these for future use so tuck them into your financial binder when you are finished and compare them to the next time you challenge yourself to a No Spend month.

Also, don’t worry if you aren’t able to spend $0 on a day. It happens. Don’t beat yourself up about it. Just buckle down for the next day!

No Spend Challenge Worksheet

This page is set up for you to write down your rules, and if there is an exception to that rule…write it down. At the top is the savings goal.

This is one sheet you want to take your time with. Be honest and analyze your shopping habits as well as other family members that will be joining the challenge.

There are always some habits you can give up on, at the very least for a month.

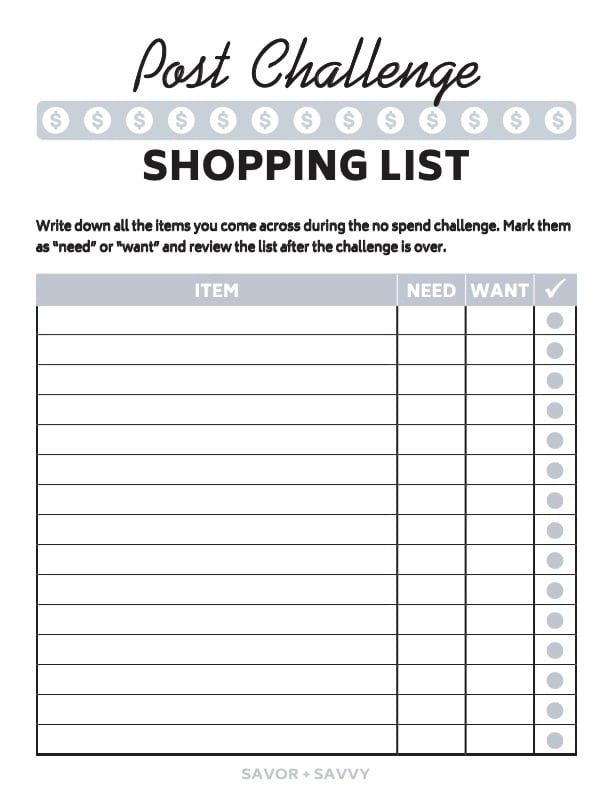

Post Challenge Shopping List

This worksheet can be addressed in a couple of different ways. I like to use it to track what I ran out of – they are all “needs” for me.

I did add the “want” section because I think it is also good to add in things we have wanted throughout the month.

It’s funny, but when I look back on my “wants” I find that I can easily live without it. Don’t skip this step. It’s important to see how your spending habits can change going forward.

I found most of our family’s spending happened on weekends when we ate out due to convenience or lack of planning. I always felt like that was wasted money. So, I had the family try it just for weekends to see if it was possible. Spoiler alert: It totally is!

Determine the rules for what you are allowed to buy. Obviously, you need to keep paying your bills, and you shouldn’t shortchange things like medications, but it is reasonable to cut off eating out, video games, coffees, and virtually anything purchased online. These rules are unique for each family, so spend time to agree on what you can and cannot accomplish.

💰 The Benefits

👉Extra savings – The biggest benefit for most of us is the extra money that we will have in our checkbook after 30 days. To get an idea of how much that is, look back over your last 30 days and add up what you are disallowing for the challenge. I bet you’ll be surprised!

👉Discover your senseless spending – One of my favorite parts of doing this challenge is being self-aware of spending. It only took us a short bit (not a full month even) to have our eyes wide open to our senseless spending. We didn’t even realize it. It is said that American’s spend on average $100 a day.

Yes, this is the average, but it is a great starting point for all of us to dig deep and think about exactly how we spend our money. I am also using this free printable daily spending log to track my purchases.

For most of us, it only takes a few days of writing down what we spend to see exactly what we can cut out. Bye Bye Caramel Macchiato!

💡Tips For A Successful No Spend Challenge

Let’s get you started with the best tips and tricks to help the next 30 days so smoothly for you and your family.

Save Money on Food

📌Make a Meal Plan. This is huge! You can’t win a no spend challenge if you don’t plan. Start the month off by buying your groceries based on the meal plan. Utilize #2 below before you go to the grocery store to minimize the amount you have to buy.

Try to incorporate family favorites along with a few new frugal meals to stretch the dollars. It eases the change for everyone. Here are 10 weeks of Frugal Meal Plans to get you started.

📌Go Through Your Pantry First. When making your meal plan, go through the pantry to see what you already own. When we did ours, we pulled out the two jars of Pumpkin Bisque I bought at Trader Joe’s a couple of months ago and didn’t eat. There you go – one meal down!

My husband likes to buy canned oysters and sardines so we put that as one lunch for him. You will be surprised how much food you already have in your pantry. Fill it all into the meal plan.

📌Meal Prep Lunches to Take to Work. I add this as a separate item because too many of us eat out for lunch and that was a huge burden on my family’s weekly budget. When I saw on my credit card statement years ago that my husband spent $6 on something for breakfast and $12 on lunch, I knew I had to make the change. He didn’t love that food at all and so it felt like we lost out twice.

I doubled down to meal prep his lunches and even do it before I go out of town to visit my mom. Do the math on that. $18 x 20 work days= $360 per month is what we would have spent if we kept that up! No, nope!

📌Make a List of Cheap Meals to Eat and Actually Eat Them. If you don’t already do this, research and make a list of cheap eats. When the challenge is over, incorporate 1-2 of them each week in your future menu planning so you can go forward with meal planning costing you a bit less than it was prior to the challenge.

Cut Back on Retail Therapy

📌Leave Money at Home. If you have to go out and about, leave your money at home. Credit cards included. Most of us don’t have that much discipline so it’s best to leave money at home altogether. If you don’t have money to spend, it doesn’t matter how much you want the object of your desire.

📌Unsubscribe to Email Lists. This is crucial! Don’t skip this step at all. This just leads to impulse buying. Do you really need the 40% off Groupon email? No, you don’t. You don’t know what is on Groupon so why do you need 40% off? Can you see that logic at all? Stay off email lists – period.

📌Don’t Visit Any Retail Websites At All. Just like the email lists, stay off of all retail sites during your no spend challenge. This is not the time to window shop and dream up what you should buy.

📌Don’t Go to the Store. If you have to pick up items, go alone and when you are not hungry. This isn’t the time to wander Target to just “see what they have” or to take everyone on a quick run to the grocery store to grab milk. If you need milk, go in and grab it and get out. Put your blinders on and focus on your goal for the challenge. “Gathering” is the enemy of the No Spend Challenge.

🖥️ Grab Here

💸 More Free Financial Printables

$1000 Emergency Fund Challenge

💲 More Savings & Budget Challenges

🥄 Free Printables For Meal Planning

Organizational Binder with Menu Planner

🥣 Frugal Meal Ideas

10 Weeks of Recipes Frugal Meal Plans

39 Grocery Items You Can DIY Instead of Buy

Let me know if you started and/or completed a no-spend challenge! I am very interested to hear how it worked for you. Also, any tips are welcome. We’re all in the same boat!

Hi!

Ginny Collins is a passionate foodie and recipe creator of Savor and Savvy and Kitchenlaughter. Indoors she focuses on easy, quick recipes for busy families and kitchen basics. Outdoors, she focuses on backyard grilling and smoking to bring family and friends together. She is a lifelong learner who is always taking cooking classes on her travels overseas and stateside. Her work has been featured on MSN, Parade, Fox News, Yahoo, Cosmopolitan, Elle, and many local news outlets. She lives in Florida where you will find her outside on the water in her kayak, riding her bike on trails, and planning her next overseas adventure.

Leave a Reply